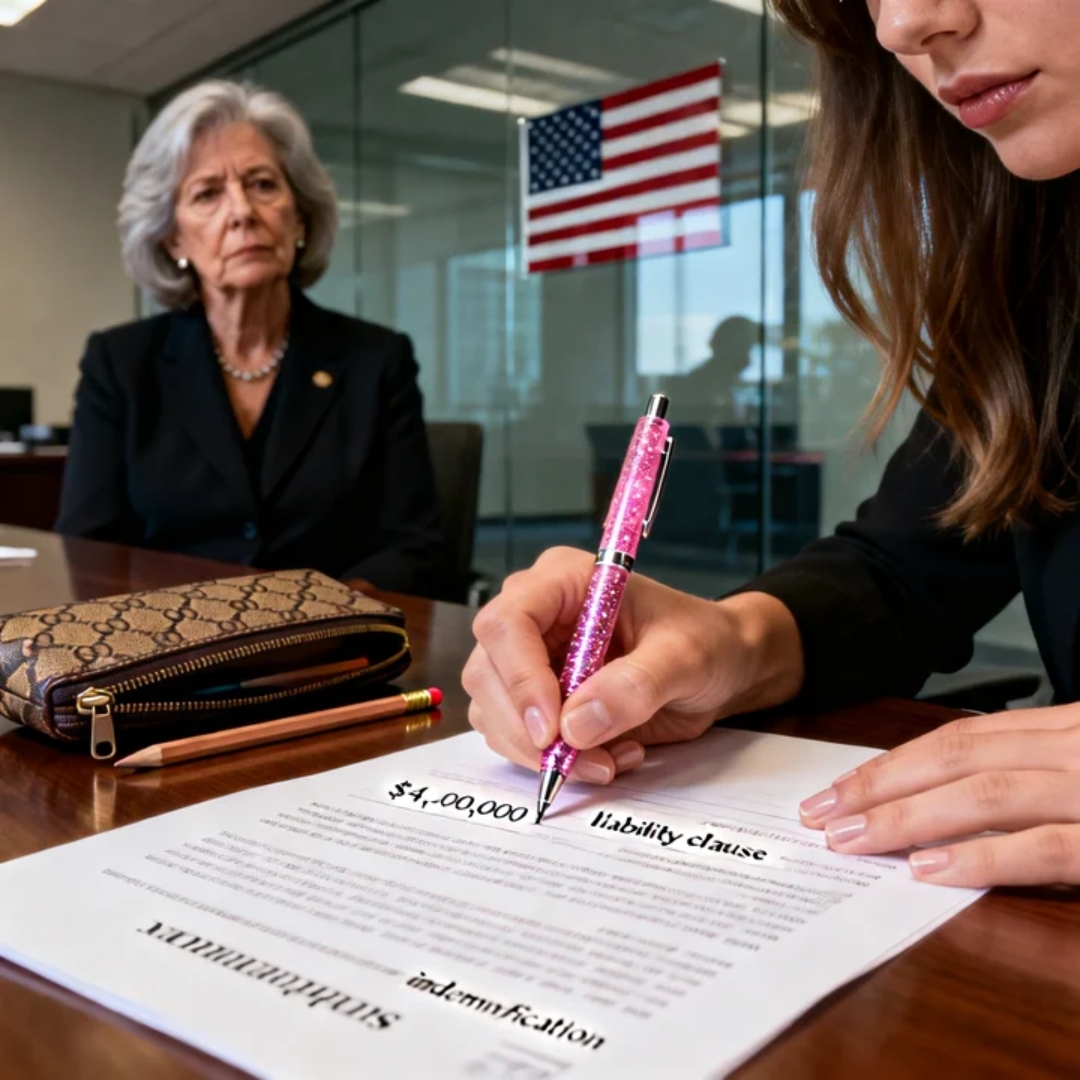

The first time Lily Hart signed a supplier agreement, she used a pink glitter gel pen that smelled like strawberries.

Not metaphorically. Not as some poetic detail I’m adding now. She literally reached into a Louis Vuitton pencil pouch—one of those tiny, shiny things you’d expect to hold lip gloss, not legal obligations—clicked the pen like it was a fidget toy, and scrolled her name across a clause that read “$4,000,000 liability cap” as if she were autographing a yearbook. While she did it, she hummed along to a TikTok sound about margaritas and manifesting.

That was the moment it hit me: the company’s firewall wasn’t in our servers or policies.

It was me.

And I was about to be set on fire.

I’d been at the firm—pharmacy and clinical trials—long enough to watch whole eras come and go. Twenty-five years of risk and compliance in the United States will sand the softness off your voice and replace it with something sharper: a habit of reading the footnotes, a reflex to stop smiling when someone says “don’t worry,” and a permanent awareness that lawsuits don’t care how cute your branding deck looks.

I had survived five CEOs, three “transformational rebrands,” a merger that nearly broke HR in half, and a ransomware attack that took out payroll the week before Christmas. I was not the person who took selfies at conferences or wore sneakers to the office to look innovative. I was the woman who could walk into a glass boardroom, say, “We can’t ensure that,” and walk out with everyone pretending I hadn’t just saved their stock options.

Risk officer wasn’t just my title. It was my job to stand at the edge of a cliff and be the last voice people heard before they stepped off.

The thing is, nobody ever thanks the guardrail. They only notice it after it’s gone.

Then came Lily.

Twenty-six. Fresh out of business school with a LinkedIn headshot that looked like it belonged on a dating profile for trust-fund finance interns. Perfect teeth. Perfect lighting. Perfect confidence. She was the founder’s daughter, which meant she skipped every process that exists to keep companies from hiring chaos in heels.

She waltzed into a director-level role like the building had been waiting for her, like the rest of us were just furniture in her origin story.

Her business card said Strategic Impact.

Her emails were all emoji-laced fog.

“Can we circle back on bandwidth synergy?” she’d write, like she’d swallowed a deck of corporate Mad Libs and regurgitated it into Outlook.

I tried. I truly did.

I offered to walk her through our risk matrix, that ugly grid that looks boring until it saves your life. I suggested she shadow a compliance review. I invited her to team standups so she could see how we triaged vendor escalations and handled HIPAA-adjacent landmines without creating a federal incident.

Every time, she gave me the same tight laugh, the same bright eyes, the same line.

“I’m more of a big-picture girl.”

Apparently, the big picture didn’t include liability ceilings, data retention triggers, or the small, deadly clause in our umbrella policy that stated I had to personally sign off on any exposure tied to clinical trials.

And it definitely didn’t include the fact that one addendum—one detail, one signature, one name—was holding up the entire insurance structure like a steel beam hidden inside drywall.

Lily moved fast.

Within a month, she was leading “innovation initiatives” and proposing we switch vendors mid-contract to align with our “agility objectives.” She wanted to swap out a third-party courier for biologic samples because the new one had a slick website and promised “real-time vibes.” That swap would have triggered breach penalties in the millions. I caught it, drafted an exception memo, got legal to back-channel the vendor’s general counsel, and reclassified the change as a strategic migration.

She never realized what she’d almost done.

She high-fived her assistant like she’d cured cancer on a lunch break.

I kept things running quietly. Efficiently. No drama. But I could feel the way she looked at me in meetings—like I was a rotary phone sitting in a 5G world. She’d smile when I spoke, but there was always that micro-squint behind her lashes, like she was waiting for me to slip. Or better: to disappear.

The shift happened on a routine client call.

We were expanding an oncology trial with one of our biggest partners, a Fortune 100 name that had a compliance team the size of a small town. The meeting was on Zoom, because everything in America is on Zoom now—even disasters.

Lily led the call, which was its own little horror show of gradients and buzzwords. She told the client we were “fully covered” under Tier 4 indemnity clauses, even internationally.

It wasn’t just incorrect.

It was lawsuit-inducing incorrect.

My mind went cold the way it always does when someone says something that could put patients at risk. Because that’s what she didn’t understand: liability isn’t abstract when you’re dealing with human bodies, investigational drugs, and cold chain shipments. It’s not a line item. It’s a person. It’s a family. It’s a courtroom.

I paused. I waited. I prayed someone else would fix it.

No one did.

So I cleared my throat and said, gently, with zero ego, “Just to clarify, our current coverage extends only to Tier 2 liabilities within FDA-regulated territories. Expansion beyond that would require a new rider, which is still under review.”

The client nodded. Took notes. Said, “Thank you for the clarity.”

Lily smiled.

But her knuckles were white on the mouse.

Her eyes didn’t move.

Her voice, when she spoke, was sugar poured over broken glass.

“Thanks, Barbara.”

And in that moment, I crossed the invisible line from “quiet firewall” to “threat that needs deleting.”

I didn’t know it yet, but I had just stepped into the kind of corporate storyline that ends with security escorting you past your own desk.

The call ended. Lily hit “Leave Meeting” like she was swatting a fly. No recap, no “great job team,” nothing. Just that silence that feels like static before lightning.

Ten minutes later, my calendar chimed.

HR — 11:30 a.m. — Pamela Hart

Pamela just so happened to be Lily’s mother.

Pamela, who wore silk blouses that cost more than my first car. Pamela, whose perfume smelled like a boutique candle called something like Lavender & Litigation. Pamela, who once called my OSHA presentation “overkill for people who know how to sit in chairs.”

The email was short. Two sentences.

“Hi Barbara, can you stop by HR at 11:30? We’d like to discuss your tone on today’s client call.”

Tone. Not content. Not accuracy. Not the $19 million in potential exposure I had just quietly prevented.

Tone.

I replied with a simple, “Of course.”

Then I leaned back in my chair and exhaled so hard my reading glasses fogged.

I wasn’t angry yet.

I was disappointed, the way you are when you watch someone light a candle next to a gas leak and smile about the ambiance.

At 11:29, I walked into HR like I always did. Badge clipped. Notes in hand. Calm face on.

Pamela didn’t offer me a seat. She just pointed.

Her smile was tight enough to hold a grudge.

Lily wasn’t there, of course. That would have required an actual conversation.

Pamela opened with, “Barbara, we’ve received concerns regarding the tone you used during this morning’s client interaction. It was perceived as undermining and dismissive.”

I blinked once.

“I corrected a factual error about our liability coverage,” I said. “I did it clearly and professionally.”

“We’re not questioning your knowledge,” Pamela replied, folding her hands like a court stenographer preparing to record a lie. “But when junior executives are leading key meetings, it’s important we maintain a supportive environment. Your interjection could be seen as… credential intimidation.”

Credential intimidation.

I actually laughed, just once, the way a cough escapes you when your body can’t hold the absurdity inside.

Pamela didn’t flinch.

She’d rehearsed this.

“If someone feels intimidated by accuracy,” I said, calm as a surgeon, “perhaps the issue isn’t the credential.”

“We’re not here to assign blame,” she said. “We just need alignment.”

Alignment: the corporate word for stop being smarter than the boss’s daughter.

Pamela continued, “Let’s consider this a coaching moment. Future interactions should aim to elevate, not correct.”

I nodded. Thin smile. Steel spine.

Then I stood and walked out.

Back at my desk, I opened the compliance log and documented everything. Time. Date. Summary. The way I always did, because in America, the paper trail is either your parachute or your coffin.

Then I opened my personal encrypted archive and pulled up the rider amendment I’d filed three months earlier, the one that tied our entire liability policy to my named officer status.

I reread the line twice.

Automatic policy void shall be triggered 72 hours post-termination of named officer without carrier notification.

My name was still on it.

For now.

That HR meeting didn’t scare me.

But it told me, loud and clear, that the countdown had begun.

The next morning, I showed up in my usual navy blazer, thinking this would be a checkbox meeting. Maybe a warning. Maybe a little HR paper-pushing to satisfy Lily’s ego.

Instead, the conference room was already staged.

A printed packet sat at my seat like a tombstone.

Pamela was there, wearing her I’m not mad, I’m legally prepared face. Next to her sat another HR staffer I didn’t recognize—young, nervous, there as a witness, not a participant.

No legal rep. No manager. No conversation.

Just the ritual.

Pamela didn’t waste time.

“Barbara, after a thorough review of recent events, we’ve determined your conduct toward Director Hart has created what we’re categorizing as a hostile work environment.”

I said nothing.

She flipped pages like she was auditioning for a courtroom drama.

“Specifically, your behavior during the recent client meeting, combined with ongoing patterns of undermining and credential-based posturing, constitute workplace bullying under section 4.3 of our professional conduct policy.”

Credential-based posturing.

Like my certifications—the ones required to keep regulators and underwriters from chewing us alive—were some kind of peacock display.

“If you mean the correction I made about international indemnity caps,” I said, “it was factual.”

Pamela’s eyes didn’t blink.

“It’s not about the facts. It’s about the impact.”

She said it like scripture.

“What’s the actual allegation?” I asked.

Pamela leaned back slightly, the posture of someone who thinks they’ve already won.

“We believe your presence in meetings has become combative. Your certifications and corrections, while accurate, are delivered in a way that intimidates and diminishes newer team members.”

“This is about Lily,” I said, flat.

Pamela frowned. “This isn’t about individuals. It’s about dynamics.”

I stared at her for a beat.

Then she slid the final page toward me.

“We’re terminating your employment. Effective immediately. Your badge has been deactivated. You’ll be escorted to collect your personal items.”

No PIP. No transition. No handoff. No grace.

I didn’t touch the paper.

“You understand this puts the company’s coverage at risk?” I asked, not pleading, not panicking—just genuinely curious whether anyone in that room knew what they’d done.

Pamela’s lips curled like she was tasting something sour.

“We reviewed our exposure,” she said. “We’ll manage.”

No, you won’t, I thought.

But I didn’t say it out loud.

I stood, picked up my leather binder—worn edges, post-it notes, two decades of quiet disasters—and from the inner pocket, I slid out a single cream-colored envelope. Dated three months ago. Unmarked.

I didn’t wave it.

I didn’t threaten.

I tucked it under my arm like it was any other memo, because that’s how you carry something dangerous when no one realizes it’s lit.

Security met me at my desk.

Thomas. A guy I’d known for years. He couldn’t look at me as I packed a small box: my National Risk Management Council certificate, a desk cactus, a USB fan that clicked every three seconds, and the little peppermint gum tin I kept for long audits.

No one spoke.

Not Mary from accounting, who once told me I was the only reason she hadn’t sued over ergonomic violations.

Not procurement, where I’d untangled fraudulent vendor chains.

No one.

I walked out without saying goodbye.

They didn’t take my laptop.

I’d wiped it myself the night before, because paranoia is just foresight with experience.

Outside, I stood in the bright American sun for a full sixty seconds, breathing air that didn’t smell like fluorescent lights and corporate fear.

Then I walked to my car, set the envelope on the passenger seat, and let out a long, slow exhale.

You’d be amazed how fast people forget you once your badge stops working.

The first day after they fired me, I tried to pretend it was just another Friday. I made coffee like I still had a 9:00 a.m. call. My work inbox was gone. Of course. But my phone still had numbers.

I called the CFO first.

Straight to voicemail.

I didn’t leave a message. He either knew why I was calling or would pretend he didn’t.

I texted Monica in legal—someone I’d once split a bottle of wine with in Boston after a compliance conference, swapping horror stories about indemnity loopholes.

Her reply came twenty minutes later.

“I’ve been advised not to comment on employment matters. I’m sorry.”

By Monday, the silence had hardened into something almost physical. No LinkedIn messages. No “are you okay?” Not even a cowardly emoji.

They weren’t just ignoring me.

They were treating me like contamination.

And I understood why.

Lily had framed it as harassment. “Hostile work environment.” “Bullying.” Those phrases don’t just fire someone—they poison the room around them. Anyone who spoke up for me risked being dragged into her story.

So I stopped trying to talk to them.

Instead, I opened my personal laptop and pulled up the email I’d sent myself three months earlier.

Subject line: RISK AMENDMENT — WRITER 14C — NOTARIZED COPY

Two attachments.

First: the confirmation letter from Mutual Shield Insurance, effective May 14, signed by the carrier and by me.

It stated, in crisp language that made my stomach go calm:

Coverage shall be contingent on uninterrupted designation of Barbara Lynn, NRMO, and shall retroactively void if said party is removed without carrier notification, with a 72-hour window to correct.

Second: a timestamped memo I wrote after my first uncomfortable meeting with Lily. Dated. Detailed. Labeled plainly: Personal records only.

It documented her refusal to attend a compliance briefing, her dismissal of policy documents, her habit of speaking in confident nonsense.

And it ended with one line bolded:

Should employment status change due to non-performance-related concerns, this memo may be used to confirm misalignment with procedural protocol.

I didn’t write it for revenge.

I wrote it because you don’t spend decades in risk without understanding one truth: the worst case isn’t a lightning strike.

It’s people.

People with power and no patience for being corrected.

The company had insisted on the policy structure. The board liked the optics of “stability.” Investors like it when named officers aren’t musical chairs. I’d even warned them: tying coverage to a named risk officer was a lever, and levers can snap.

They nodded. Approved. Signed.

Then they fired the lever.

Three days after they walked me out, the company posted a press release.

The kind of glossy, optimistic thing biotech firms in the U.S. love—stock images of lab coats, inspirational quotes, vague promises about innovation.

Title: Exciting New Partnership: Phase II Oncology Trials Begin in Tri-State Region

Buried in paragraph three was the line that made my coffee taste like ice:

“We’re proud to onboard Dr. Rajin’s team under our current clinical risk coverage with full indemnification protocols in place.”

No footnote. No nuance.

Which meant they were operating like the policy was active.

It wasn’t.

Not since Tuesday at 8:16 a.m., when they terminated me and didn’t notify the carrier within the required window.

I’d marked the deadline in my planner like a birthday.

Underlined twice.

The trial site they were onboarding wasn’t low-risk. It was the opposite: international vendors, unvetted third-party courier, new team, high-pressure timeline. A compliance landmine.

And they were walking into it barefoot, convinced the boots were still on.

That afternoon, I made one call—not to the company, not to the board, not to a reporter.

To the insurance carrier.

Mutual Shield, this is Colleen.

Her voice was crisp. Professional. The kind of voice that doesn’t waste syllables because wasted syllables turn into liability.

“Hey, it’s Barbara Lynn,” I said. “Quick one. Just confirming someone’s still scheduled to be on site for the audit Friday.”

A pause.

“We are,” Colleen said. “But there’s been an internal flag. We may escalate the audit scope.”

I felt my mouth curve, not into a smile—into recognition.

“Understood,” I said. “Just wanted to make sure you had the termination paperwork on file.”

“We do,” she replied.

Ice, facts, clean edges.

“It’s been acknowledged.”

“Appreciate it,” I said.

We didn’t say goodbye. We didn’t need to.

When I hung up, I didn’t feel joy.

I felt that cold humming sensation you get when you know a storm is coming, but it’s not your house anymore.

On Friday morning, I sat in a corner café across the street from the glass building that had swallowed twenty-five years of my life.

I chose the table on purpose.

Close enough to see the lobby doors whoosh open like a spaceship.

Far enough to not be seen.

I watched them file in—mid-level managers clutching tote bags with the new logo, executives wearing smiles that didn’t reach their eyes. I saw the CFO checking his watch like he was timing an organ transplant. I saw Monica from legal holding her iPad like it could shield her from incoming fire.

Then Lily arrived, front and center, in a blazer too tight and a smile fresh from a tutorial titled How to Seem Competent in Three Easy Steps.

She carried a clipboard.

It was blank, of course.

Just paper and bravado.

Colleen arrived right behind her.

Navy suit. Hair pinned up. No unnecessary warmth.

Underwriters like Colleen don’t hug. They dissect.

Lily did a little greeting gesture, too enthusiastic, like she’d mistaken an audit for a networking event.

Colleen didn’t smile back.

Inside, they ushered Colleen into the “war room,” the same conference room where I’d sat for years—closest to the compliance folders, farthest from the pastries.

They started with pleasantries. They always do.

Then the binder.

Then the personnel documentation tied to designation-sensitive clauses like mine.

I could picture the exact moment Colleen would flip to my record.

Termination date.

No replacement form.

No carrier notification.

No named successor.

And then she would ask the question that turns a room into stone:

“Who is currently designated as named risk officer?”

And nobody would answer, because there wasn’t one.

Because they never replaced me.

Because they thought firing me was just internal politics.

A clean break.

A win.

But you can’t “win” against a contract.

The paper doesn’t care who your father is.

It doesn’t care how young and bright you look on LinkedIn.

Fine print is not impressed by glitter pens.

Later, I learned what happened in that room, because in America, secrets leak faster than cold chain shipments in a heatwave.

Colleen flipped through the binder. Page after page. Quiet. Precise.

Then she paused.

“Termination paperwork for Barbara Lynn,” she said, and laid the sheet flat.

The CFO chuckled, trying to make it sound casual. “Oh, yes, Barbara. We’ve had some staff transitions. New energy, you know.”

Colleen didn’t smile.

She read out loud, the way someone reads a verdict.

“Named risk officer Barbara Lynn. Terminated Tuesday, 8:16 a.m.”

Silence.

Then her eyes lifted.

“Who replaced her as named risk officer?”

The CFO blinked.

“I don’t think we’ve officially filed that yet. We’ve redistributed the duties internally.”

Colleen’s expression didn’t change.

“Did you file a named officer replacement form with Mutual Shield?”

“No,” he admitted. “Was that required?”

That’s when Colleen’s pen hit the table with a tiny, final click.

“The policy lapsed,” she said, calm as ice, “seventy-two hours after termination due to failure to notify and absence of a designated successor.”

The CFO’s mouth opened, then closed.

He looked like a man watching his own numbers dissolve.

“I thought coverage carried forward,” he said weakly.

“Only if the designation is maintained,” Colleen replied. “It’s in your addendum. Section 7C. I have the signed copy here.”

Monica stopped typing.

Colleen continued, steady, merciless:

“Effective Friday at 8:16 a.m., you have no active clinical risk coverage.”

“You are uninsured.”

The room didn’t explode. It didn’t need to.

Disaster in corporate America rarely looks like fire. It looks like silence. It looks like someone realizing the thing they assumed was permanent was actually conditional.

And then, right on cue, Lily walked in with her blank clipboard and her bright, clueless smile.

“Hey! Everything going well in here?”

No one answered.

For the first time since she arrived, Lily looked genuinely confused—not threatened, not irritated—just lost.

The CFO stood and said, without looking at her, “Lily, please step out.”

“But I thought—this is my audit—”

“Now,” he said, voice cracked.

She left like a child dismissed from the grown-ups’ table.

Colleen didn’t even track her with her eyes. Lily was irrelevant now.

The paper was the only authority in the room.

Colleen looked back at the executives and said, quietly, “Any action taken under the assumption of current coverage after the lapse is considered an uncovered event, including clinical onboarding, third-party courier engagement, and data handling.”

The legal counsel asked if there was recourse.

Colleen nodded once.

“There’s an emergency reinstatement protocol,” she said, “but it requires board-level approval, an operational freeze during re-evaluation, and full audit exposure of the termination decision.”

The word termination landed like a gavel.

Because now it wasn’t just about insurance.

It was about why they fired the person whose name held the policy together.

It was about ego and nepotism and the kind of HR theater that plays well internally until it hits the outside world, where regulators, underwriters, and investors don’t care about “tone.”

They care about facts.

By noon, phones were ringing. Slack channels were on fire. People who hadn’t walked the hallways in years suddenly remembered their legs.

Across the street, I watched the top floors of the building like you watch thunderheads gather.

A junior staffer texted me from an unknown number.

“What did you do?”

I stared at it, then typed back:

“Nothing.”

Because it was true.

I hadn’t leaked documents. I hadn’t called reporters. I hadn’t sabotaged a thing.

I’d simply stopped holding up the ceiling.

And when you remove a keystone, the arch doesn’t fall because you pushed it.

It falls because it was never built to stand without you.

By Monday, the board call—supposed to be routine—turned into something sharper.

The underwriter’s lapse letter hit inboxes before anyone could spin it. Clean language. Precise timestamps. No mercy.

Then someone, somewhere, leaked the HR memo about “credential intimidation.”

Screenshots spread the way scandals spread in American workplaces: quietly at first, then everywhere at once, then suddenly on social media under anonymous handles with profile pictures of microscopes and sarcasm.

Investors don’t care about internal culture wars.

They care about why nobody noticed the gap.

Why no one filed a replacement.

Why the company onboarded a high-risk trial site while uninsured.

Why an audit had to explain their own contract to them like a parent reading bedtime rules.

A voicemail came to my phone from someone in the company’s legal department.

“Hi Barbara, this is Cassandra from—”

I swiped it away without listening.

Let them hope.

There was nothing left for me to fix.

The company had built the trap. Approved it. Signed it. Celebrated it. Ignored it.

Then they stepped into it wearing patent leather heels and glitter-pen confidence.

I didn’t burn the place down.

I just stopped being their firewall.

And the moment the paper noticed I was gone, the whole building started to go dark.

By Monday morning, the building didn’t look different from the outside.

Same glass. Same lobby music that sounded like an elevator trying to flirt. Same security desk with the same bowl of mints nobody ate. If you didn’t know what was happening on the upper floors, you’d think it was just another clean, ambitious American workweek—another “grind” Monday in a city that runs on cold brew and denial.

But inside, the air had changed.

It wasn’t panic yet. Panic is loud. This was worse.

This was the quiet, clinical kind of fear that spreads when people realize the rules they’ve been playing with were real the whole time.

The first sign wasn’t an announcement. It was absence.

The company-wide Slack channel went unusually still. No memes. No “morning team!” no pastel confetti reactions on leadership posts. Even Lily’s usual stream of cheerful nonsense—sparkles, rocket emojis, “Let’s gooo”—vanished like someone had unplugged her.

Then the calendar holds started.

People didn’t get invited to meetings. They got swallowed by them.

“Quick sync” became “URGENT.”

“Touch base” became “Immediate.”

“Review” became “Containment.”

In the United States, corporate disaster doesn’t start with alarms. It starts with calendar invites multiplying like bacteria.

Kevin—the CFO who used to talk big when the board wasn’t watching—spent the entire morning moving between conference rooms like a man trying to outrun his own math. Monica from legal walked behind him with a laptop and the face of someone realizing she’d spent years protecting the wrong people.

And Lily?

Lily stayed visible.

That’s what these types do when the floor starts cracking. They don’t run. They perform stability.

She posted an internal update that read like a scented candle label: “Alignment, clarity, forward momentum.” She spoke in meetings with that same bulletproof smile, the one that made junior staff feel like they were standing too close to a spotlight. She tried to make it look like the audit was just a “routine recalibration.”

But the underwriter’s letter didn’t care about Lily’s tone.

It didn’t care that she was the founder’s daughter.

It cared about one thing: the paper trail.

And the paper trail had a pulse.

By noon, the board chair called an emergency session. Not a Zoom check-in. Not a soft discussion. An actual emergency meeting, the kind where assistants stop smiling and start typing like their careers depend on it.

Because now the issue wasn’t internal.

It was external.

External is what terrifies companies. Internal drama can be buried in HR files and “culture initiatives.” External exposure hits partners, regulators, insurers, investors—people who don’t get distracted by vibe decks.

A biotech trial site doesn’t pause because someone’s feelings are bruised.

It pauses because coverage is gone.

I found out they’d already started making calls.

Not to me first. Not an apology. Not a request for help.

They called everyone else.

Crisis PR. Outside counsel. A boutique consulting group that promised “rapid compliance stabilization” for a fee that could fund a small hospital wing.

They did what American corporations always do when reality shows up: they tried to buy distance from it.

But you can’t buy time back.

The clock had already clicked past the window.

And then the first partner email hit.

It wasn’t dramatic. It wasn’t angry.

It was professional, which is how you know it’s dangerous.

“Hi Team, in light of recent developments, we are requesting immediate written confirmation of active clinical risk coverage and indemnification status prior to continuing onboarding activities.”

I could practically hear Monica’s blood pressure spike through the screen.

Because that email wasn’t just a question.

It was a signal.

A Fortune 100 partner doesn’t ask for confirmation unless they’ve already heard something. And once a partner starts asking, the story is already walking out the door.

By late afternoon, the rumor wasn’t a rumor anymore.

It was a sentence people said quietly near printers.

“Do we actually not have coverage?”

“Is it true the policy lapsed?”

“Wasn’t Barbara the named officer?”

My name—my actual name—started moving again through the building like a ghost no one wanted to acknowledge.

And that’s the thing about getting erased.

You’re invisible until you become inconveniently necessary.

That evening, my phone rang.

Unknown number, local area code. Then again. Then a third time.

I let it go to voicemail. I listened only once, because curiosity is a bad habit I haven’t managed to quit.

“Barbara… hi, it’s Kevin.”

Kevin. The man who used to say, “If you ever leave, I’m leaving with you.”

His voice was thinner now, like a shirt that’s been washed too many times.

“We need to talk. There’s… there’s been some confusion about the… designation. We just want to understand what’s on file.”

On file.

He didn’t say “I’m sorry.”

He didn’t say “We were wrong.”

He said “confusion” the way people say “weather,” like it just happens.

I didn’t call back.

Not because I wanted revenge.

Because I knew exactly what would happen if I did.

They would pull me into their problem like quicksand. They would try to turn me into a solution without turning me into a person again. They would ask me to fix the mess created by the same arrogance that had escorted me out with a cardboard box.

No.

If they wanted my help, they could start with truth.

The next day, Tuesday, the real damage started showing.

A clinical site reported a cold-chain irregularity. Small, on paper. The kind of issue that happens more often than the public ever realizes. A temperature drift. A sensor flag. A shipment that might be compromised and might be fine.

Normally, you document it, you escalate, insurance stays calm in the background like a safety net.

But now?

Now every small incident was radioactive.

Because it wasn’t just a shipment anymore.

It was an uncovered event.

And uncovered events are how partners decide you’re not worth the risk.

That afternoon, someone leaked the HR memo.

Not the whole file. Just enough.

A screenshot of the phrase “credential intimidation,” highlighted like a joke somebody couldn’t believe was real. Another screenshot of the word “hostile,” sitting next to my name like a stain.

It spread fast.

Not because people loved me.

Because people love proof.

Employees don’t share gossip like that because they care about justice. They share it because it confirms what they’ve felt for years: the rules aren’t applied equally.

And when America smells hypocrisy, it doesn’t whisper.

It eats.

By Wednesday, the founder himself finally appeared.

He’d been quiet through all of it, which is what wealthy men do when their kids make messes—they wait to see if someone else can clean it before they step into the room.

He called a leadership huddle. A tight group. Closed doors. No assistants. No recording.

But someone always talks.

And what I heard was this:

He asked one question.

“Why did we fire her?”

Not “Did we fire her.” Not “Was it legal.” Not “Did we document.” Just why.

Pamela, of course, tried to frame it as “culture.” Lily, of course, tried to frame it as “team dynamics.” Kevin, of course, tried to frame it as “miscommunication.”

But the underwriter’s letter—Colleen’s clean, merciless language—had made one thing impossible.

You couldn’t pretend this was about feelings anymore.

It was about numbers.

And numbers don’t care about family.

Somewhere in the middle of that meeting, Lily finally cracked.

Not publicly. Not in a dramatic way.

But the mask slipped.

She said, “I didn’t know it was tied to her specifically.”

As if that made it better.

As if ignorance is a defense when you’re in charge.

As if telling a room full of adults, “I didn’t read the part that mattered,” is not the most damning confession of all.

That’s when the founder turned to legal and asked about reinstatement.

Monica’s response was a tight rope over a pit.

“Yes, there is an emergency reinstatement process. But it triggers an operational freeze and board oversight. It also requires full disclosure of the termination.”

Full disclosure.

That phrase is where vanity goes to die.

Because full disclosure means you don’t get to control the story.

It means the investors see the HR memo. The partner emails. The timeline. The fact that the company cut its own safety line because someone didn’t like being corrected on a call.

And once investors see that, they start thinking a thought no leadership team can survive:

If they did this to their risk officer… what else are they ignoring?

By Thursday, the company stopped posting. No upbeat LinkedIn quotes. No lab coat photos. No “exciting partnership” announcements.

Silence is a tell.

Silence is what happens when PR can’t find a sentence that won’t be used against them later.

That night, I went grocery shopping like a normal person. I stood in the cereal aisle under fluorescent lights and listened to strangers argue about oat milk.

The world kept moving.

And that’s another thing Lily never understood.

Companies think they are the center of everything. They think their drama is the weather.

But the world is indifferent.

It only notices you when you fail loudly enough.

When I got home, I had six new voicemails.

Kevin again. Cassandra from legal. A number I didn’t recognize that I’m sure belonged to some partner firm charging by the minute.

And one message—one—made me pause.

It was from an old colleague, someone who hadn’t texted me in years.

“Barbara. I’m sorry. I should’ve spoken up. They’re saying you did this on purpose.”

I stared at the screen until it dimmed.

Did this on purpose.

Of course they were saying that.

Because when people like Lily face consequences, they don’t learn.

They blame.

They turn facts into narratives. They turn their own negligence into someone else’s plot.

They would rather call me a villain than admit they were reckless.

I didn’t reply.

Not yet.

Instead, I opened my laptop and pulled up my archive again—the amendment, the memo, the signed language.

The truth was clean.

The truth was simple.

And the truth would outlive their spin.

Across town, Lily was probably practicing a speech. Something about resilience. Something about forward motion. Something about how the company was “taking proactive steps.”

But none of that would bring back coverage.

None of that would un-open the clinical site they’d rushed into.

None of that would stop the next partner email from landing like a hammer:

“Until coverage is confirmed, we are pausing all operations effective immediately.”

And when the first partner pauses, others follow.

Not because they’re cruel.

Because that’s how risk works.

It spreads.

It’s contagious.

And when the safety net is gone, everyone steps back from the edge.

By Friday, one week from the moment Colleen said “uninsured,” the company was no longer a sleek biotech rocket ship.

It was a glass building filled with people whispering.

A founder who finally realized his last name couldn’t protect him from contracts.

A CFO staring at spreadsheets like they were crime scenes.

A legal department trying to stitch together a parachute out of emails.

And Lily—still smiling, still performing—standing in the middle of it all like a person who can’t understand why the universe didn’t reward her confidence.

Because she believed confidence was the same thing as competence.

And in America, that’s the most expensive belief you can have.

That night, I finally listened to the voicemail from legal.

Cassandra’s voice was careful.

“Barbara, we’d like to discuss a path forward. We’d like to… come to an understanding.”

An understanding.

Not an apology.

Not accountability.

An understanding.

I deleted it.

Then I poured a glass of water, not wine, and sat at my kitchen table, looking at the quiet shape of my life without their fluorescent buzz.

I wasn’t celebrating.

I wasn’t plotting.

I was simply watching cause meet effect.

Because the truth is: I didn’t destroy them.

They destroyed themselves the moment they decided competence was intimidation.

And now, with partners pausing, investors circling, and the underwriter’s letter acting like a match on dry paper, the only question left wasn’t whether the company would survive.

It was who they would throw under the bus first.

And if you think Lily was going to take the fall gracefully—

You haven’t been paying attention.

News

I’VE ALWAYS BEEN A PRACTICAL AND SIMPLE MOTHER, EVEN WITH A $6 MILLION INHERITANCE. MY SON ALWAYS EARNED HIS OWN MONEY. WHEN HE INVITED ME TO DINNER WITH MY DAUGHTER-IN-LAW’S FAMILY, I PRETENDED TO BE POOR AND NAIVE. THEY FELT SUPERIOR AND LOOKED AT ME WITH ARROGANCE. BUT AS SOON AS I STEPPED THROUGH THE RESTAURANT DOOR, EVERYTHING TOOK A DIFFERENT TURN.

The first time Patricia Wilson looked at me, her eyes didn’t land—they calculated. They skimmed my cardigan like it was…

After Dad’s $4.8M Estate Opened, My Blood Sugar Hit 658. My Brother Filmed Instead Of Helping. 3 Weeks Later, Labs Proved He’d Swapped My Insulin With Saline.

The first thing I saw was the bathroom tile—white, cold, and too close—like the floor had risen up to meet…

My Brother Let His Son Destroy My Daughter’s First Car. He Called It “Teaching Her a Lesson.” Eight Minutes Later, His $74,000 Mercedes Was Scrap Metal.

The first crack sounded like winter splitting a lake—sharp, sudden, and so wrong it made every adult on my parents’…

I WENT TO MY SON’S FOR A QUIET DINNER. SUDDENLY, MY CLEANING LADY CALLED: “DOES ANYONE ELSE HAVE YOUR HOUSE KEYS?” CONFUSED, I SAID NO, THEN SHE SAID, “THERE’S A MOVING TRUCK AT THE DOOR, A WOMAN IS DOWNSTAIRS!” I SHOUTED, “GET OUT NOW!” NINE MINUTES LATER, I ARRIVED WITH THE POLICE….

The call came in on a Tuesday night, right as the candlelight on David’s dining table made everything look calm,…

MY EX AND HIS LAWYER MISTRESS STRIPPED ME OF EVERYTHING. I OWN THIS TOWN,’ HE SMIRKED. DESPERATE, I CLOSED MY GRANDFATHER’S 1960 ACCOUNT EXPECTING $50. COMPOUND INTEREST SAID OTHERWISE, SO I BOUGHT 60% OF HIS COMPANY ANONYMOUSLY. HIS BOARD MEETING THE NEXT WEEK WAS… INTERESTING.

The pen felt heavier than a weapon. Across the glossy mahogany table, Robert Caldwell lounged like a man auditioning for…

MY PARENTS TIED ME UP AND BADLY HUMILIATED ME IN FRONT OF THE WHOLE FAMILY OVER A PRANK, BUT WHAT MY RICH UNCLE DID LEFT EVERYONE SPEECHLESS!

The rope burned like a cheap lie—dry, scratchy fibers biting into my wrists while laughter floated above me in polite…

End of content

No more pages to load