The moment he said “external relationship development,” the conference room lights seemed to get whiter, like the building itself wanted to watch what would happen next.

We were twelve people deep in a Q4 budget meeting in a glass box on the twentieth floor, the kind of room that smells like dry-erase markers and cold ambition. Outside the windows, an American skyline cut sharp against a pale fall sky—flag on the courthouse two blocks over, traffic crawling, a yellow school bus stopping at the corner like nothing in the world had ever been ruined by a PowerPoint.

Brandon—new VP, fresh haircut, fresh suit, fresh confidence imported from some leadership bootcamp that probably served kale and compliments—tapped his pen and smiled like a man who thought he could charm reality into cooperating.

“We should reallocate four hundred thousand,” he said, voice smooth, “from internal risk audits to external relationship development.”

He didn’t say what he meant. They never do. They dress it up in syllables and hope nobody hears the bones underneath.

He meant golf. He meant steak dinners. He meant vendor “summits” at resorts where the lobby has a chandelier the size of a mortgage and the bar pours whiskey like it’s therapy. He meant photos with people who sell us software and then disappear the moment the invoice clears.

I felt my mouth open before I could stop it.

“So,” I said, loud enough for the microphones to catch, “should we skip the budget review and just hand the money directly to the vendor who last gave you a branded tote bag?”

Silence hit first, the kind that slaps a room.

Then the laughter.

Not full-bodied laughter. Not joyful laughter. The quick, hungry kind junior analysts use when they’re dying for someone—anyone—to say what they’re thinking. One finance director wheezed and covered his mouth. Even Patterson, the old finance guy who stopped believing in humanity during the second Bush administration, cracked a grin like his face had forgotten how.

But Brandon didn’t laugh.

He stared at me like I’d dragged mud onto a white carpet.

His jaw tightened. His pen stopped tapping. His eyes narrowed, and for half a second it looked like he was trying to process humor the way some people try to process a corrupted spreadsheet: confused, offended, and convinced it shouldn’t exist.

That was my first warning.

I should’ve taken it.

But I’d been here fourteen years. I’d survived seven CFOs, four reorganizations, and one CEO who thought a service-level agreement was something you bought at Best Buy. I’d been promoted and demoted by men who wore confidence like cologne and read contracts like bedtime stories they didn’t understand.

I was Karen Benton, Director of Vendor Risk and Contract Compliance. The title nobody remembers until something blows up. The job that keeps the company out of headlines. I’d read more NDAs than most people read shampoo labels. I didn’t waste words. I said what mattered. And for years, my sarcasm had been treated like what it was: armor in a corporate culture that hallucinated its way through reality and called it “innovation.”

So I figured Brandon would roll his eyes and move on.

I figured wrong.

After the meeting, he didn’t confront me. He didn’t even speak to me. He gathered his notepad, stood, and walked out with the controlled calm of someone who didn’t want to risk saying something ugly in front of witnesses. That kind of restraint doesn’t come from maturity. It comes from planning.

By 5:00 p.m., the invite hit my calendar.

HR. “Brief sync.” No agenda.

Those meetings have a smell to them. Burnt toast and career regret. The kind of invite that shows up clean and quiet, and then wrecks your week like a surprise pothole.

I wasn’t sweating it at first. I went home, poured boxed red into a glass I pretended was crystal, and let reruns of Columbo hum in the background while I reviewed vendor audit reports. When my sister called, I told her what happened and laughed.

“They’re not going to fire you over a joke,” she said.

“You’d think,” I replied, “but we live in an age where sarcasm is a hostile act.”

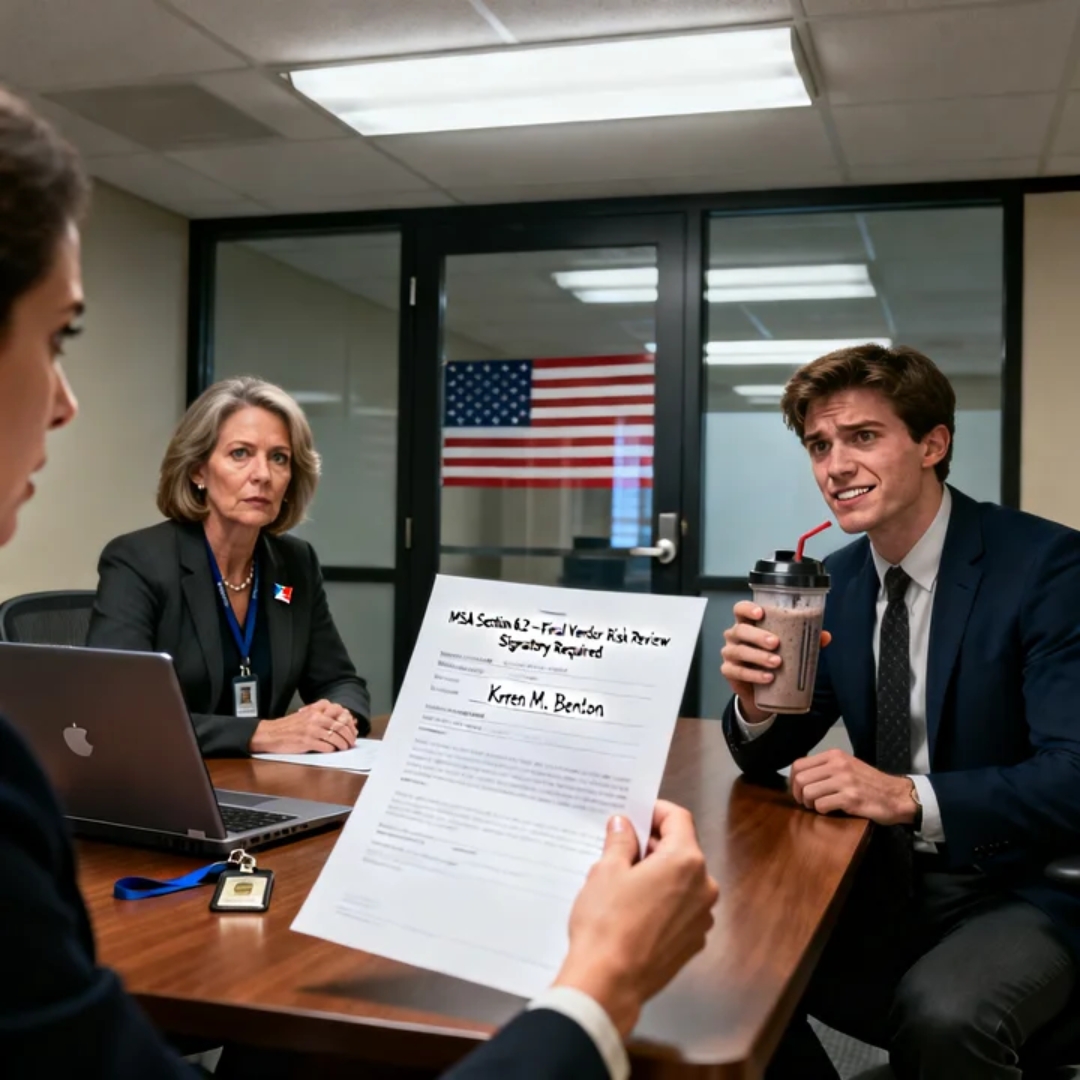

The next morning, I wore my second-best blazer and packed a yogurt in my bag, fully expecting to be back at my desk by 9:30. I walked into HR at 8:00 sharp and found Brandon already sitting there.

No coffee. No pleasantries. No “how are you.”

He scrolled on his phone like my presence was a chore.

The HR rep—Melissa, new enough to still have hope in her eyes—smiled with the brittle energy of someone trapped between a paycheck and a conscience.

Brandon finally looked up.

“Your tone yesterday was unacceptable,” he said.

No greeting. No softening. Straight to the point like he was trying to sound decisive.

“Excuse me,” I said, sitting across from him.

“You undermined leadership in front of cross-functional stakeholders,” he continued, voice flat. “That creates a hostile environment.”

He said “hostile environment” like it was a label he’d learned from a training module and was excited to use in a sentence.

Melissa nodded solemnly, like we were discussing a crisis instead of one sarcastic remark in a two-hour meeting that could’ve been replaced by an email and a nap.

“So,” I said, keeping my voice neutral, “a joke qualifies as hostility now.”

“It’s not the first time,” Brandon replied, ignoring the question. “You’ve made multiple remarks during meetings that reflect poorly on the leadership team.”

I tilted my head. “Is the leadership team allergic to humor or just selective hearing?”

Melissa shifted uncomfortably.

Brandon’s lips pressed into a thin line. He reached into a folder—because of course he had a folder—and slid a printed email across the table.

“This is one example,” he said.

Anonymous complaint. Vague phrases. “Dismissive.” “Curt.” “Not aligned.” No specifics, no context, just enough fog to weaponize.

I slid it back.

“This is a personality conflict,” I said.

“This is a culture issue,” Brandon replied.

There it was.

Culture. The corporate holy grail. The all-purpose blade. Once they decide you don’t “fit,” it doesn’t matter how long you’ve been there, how clean your record is, how essential your work is. The exit script writes itself.

Melissa chimed in like she’d rehearsed in front of a mirror. “We’d like to schedule a quick conversation tomorrow morning to wrap this up.”

Wrap this up.

Not follow up. Not discuss. Wrap.

I glanced at my watch. “Should I bring a box?”

Melissa blinked.

Brandon didn’t laugh. He never laughed when things weren’t going his way.

I stood. “Cool,” I said. “I’ll be here at eight. Before the rest of the culture rolls in.”

I walked out without raising my voice, because you don’t fight in HR. You document. You wait. You watch.

That night, I didn’t rage. I didn’t cry. I sat at my kitchen counter with the quiet calm of someone who has survived enough corporate storms to recognize the pressure drop before lightning.

Then I opened my personal laptop.

And I pulled up the Master Services Agreement.

Two hundred and twenty-eight pages. Executed six months ago. Fully signed. Fully time-stamped.

The acquisition wasn’t public yet, but anyone in risk knew it was coming. You don’t spend eighteen months tightening vendor controls unless there’s a buyer watching through binoculars.

I searched for the clause I’d fought for like my life depended on it.

Section 6.2.

Final Vendor Risk Review — Named Signatory Required.

Karen M. Benton, Director of VRCC.

Irrevocable.

No substitutions without express written release from the named party.

I stared at my name on the screen until it stopped feeling like letters and started feeling like leverage.

I printed the page. Scanned it. Sent it to my private inbox with the subject line: insurance policy.

Then I closed the laptop and packed my company machine into my bag like a gift I was returning unopened.

I didn’t know exactly how it would unfold.

I just knew they were about to cut the wrong line from the budget.

And I wasn’t going to stop them.

The next morning, I walked in at 7:59 wearing the same navy blazer I’d worn the day I got promoted to director. Not because I believed in symbolism, but because I believed in consistency. It makes people underestimate you. It makes them assume you’re predictable.

Melissa was already in the room, typing in her HR portal like she could outrun consequence with keystrokes.

Brandon showed up two minutes late with a smoothie and the relaxed confidence of a man who had never been the one on the losing end of a process.

“Karen,” he said, like we were meeting for coffee.

I sat. “Let’s do it.”

Melissa read the script in that soft, polished HR voice that says, I’m sorry this is happening, while her hands click through the steps like she’s checking out groceries.

“This meeting is to formally document the termination of your employment due to ongoing issues with professional conduct and communication…”

I stared at her.

“You mean the joke,” I said.

Brandon cut in. “This isn’t about one incident.”

“Of course not,” I said. “It’s about the fact I don’t clap when you say ‘synergy.’”

His eyes flashed.

Melissa slid the severance papers across the table. Five pages. Non-disparagement. Release clauses thick enough to choke on. Severance amount insulting. Timeline immediate. No general counsel. No acquisition liaison. No awareness of what they were breaking.

I pushed the papers back without touching them.

“I won’t be signing,” I said.

Brandon tilted his head. “That’s your choice.”

“We can’t release severance without it,” Melissa added, voice tight.

“Oh no,” I said, folding my hands. “I think you’ve released quite enough already.”

Melissa looked at Brandon for direction. He gave the smallest nod.

“Please return all company property,” she said.

I placed my laptop, badge, and charger on the table. Neat. Complete. No drama.

Then I stood, smoothed my blazer, and asked Brandon a final question.

“You’re absolutely certain this is final?”

He didn’t look up from his smoothie.

“We’ve made our decision,” he said.

“Good,” I replied. “Then so have I.”

I walked out.

Down the hall, past the break room where someone was burning toast. Past the intern who always said hi too loud. Past the crooked excellence poster I’d straightened myself six months ago because nobody else cared enough to notice.

Out the front door into air that smelled like concrete and cold morning—very American, very ordinary.

I should’ve felt something dramatic. Anger. Betrayal. Sadness.

Instead, I felt sharp. Like the edge of something finally aligned.

For three days, I lived in suspended calm. I woke at 6:30 out of muscle memory, poured coffee, stared at an empty inbox. No calendar alerts. No compliance flags. Just silence.

Then the leaks started.

Slack screenshots. LinkedIn posts. The company’s transformation team polishing their narrative like a car they’d just crashed. Brandon posted a selfie with two execs in front of a whiteboard that still had my handwriting on it. The caption praised “bold leadership” and “evolution.” He used hashtags like they were armor.

I laughed once. Quietly. Not because it was funny. Because it was predictable.

On day three, I got an email from Jenna, a junior analyst I’d mentored.

Subject: miss you.

Body: It’s weird here without you. No one knows what’s going on. They moved your team under procurement. There’s a Slack channel called Project Velocity and it’s basically Brandon bragging. We miss you. It’s a mess.

I read it twice.

I archived it.

Not because I didn’t care.

Because the worst thing I could do now was touch the machinery. They needed to keep walking into it.

That night, I opened my personal copy of the executed MSA again and cross-checked it against internal policy memos I’d saved, the ones that showed my title remained active through end of quarter. Brandon hadn’t rescinded it. He didn’t know to. HR didn’t coordinate with legal. They skipped the kill switch.

The buyer’s counsel had named me in their signoff documents by request. Their team had done actual diligence and flagged my compliance record as one of the reasons they trusted the transition.

Clause 6.2 was their idea.

I just made sure it stayed binding.

I backed up my work—vendor logs, indemnity reviews, flagged billing anomalies—onto a thumb drive and labeled it something stupid, something harmless. Confetti. Because if you name a file “leverage,” you’re asking the universe to humble you.

Then I met Adrienne.

Coffee shop. Real mugs. No QR codes. Chipped ceramic and a dark roast that tasted like it had been brewing since the late ’90s. It sat between my apartment and her new firm, neutral ground for what was essentially a legal autopsy with foam art.

Adrienne and I had shared an office wall for six years. She was the type to staple an indemnity clause to a VP’s tie if he tried to greenlight a risky vendor without review. My kind of person.

She saw me and said, “You look calm.”

“Severance packages make great coasters,” I said, sliding into the booth.

I pulled up the PDF and showed her Section 6.2.

She didn’t even touch the phone. She didn’t need to.

“I remember that fight,” she said. “You made a VP sweat. He kept asking if we could just assume good faith.”

I smiled. “Good faith doesn’t pay fines.”

She leaned in. “So they fired you?”

“For tone,” I said.

Adrienne’s face tightened. “No legal rep in the room?”

“Just Brandon and HR,” I replied. “Five pages and a smug smoothie.”

Adrienne swore under her breath. “They didn’t just mess up. They stepped on something and kept walking.”

She turned her phone toward me. An internal thread from a partner at the buyer’s law firm.

Subject: Final signoff — delay.

Vendor risk officer no longer employed.

Contractual obligation specific. Named individual. No reassignment permitted. Cannot close until resolved.

My breath left slow.

“They’re scrambling,” I said.

“They’re spinning,” Adrienne corrected. “Scrambling comes later.”

I asked the question people always ask like it’s about morality, like corporate life has ever been clean.

“So what happens now?”

Adrienne leaned back. “Now they stall. They beg for flexibility. They try to amend. But the clause is locked. The buyer insisted. Their board won’t budge.”

She looked at me, eyes steady.

“The only way this deal closes is if you sign.”

“And if I don’t?”

Her smile wasn’t kind. It wasn’t cruel. It was experienced.

“Then they’re in breach,” she said. “The rollback clause triggers. They don’t just lose face. They lose the deal.”

We drank our coffee like two women sitting quietly while a multi-million-dollar machine started rattling itself apart in the background.

“Are you going to help them?” Adrienne asked.

I stared into my cup.

“They didn’t ask,” I said.

Monday morning, the office dressed for war.

Slack banners changed from cheerful to urgent. Conference rooms booked out like hotel suites during a storm. LinkedIn titles updated within fifty yards of the building as if adding “strategic operations” could conjure competence.

I watched from my balcony in sweatpants with a bagel, like the world’s calmest spectator.

First it was files they couldn’t open because I’d been the admin of the encrypted vendor risk archive.

Then it was flagged contracts missing backup documentation stored under access credentials that were now revoked.

Then came the internal email a friend in IT forwarded me, timestamped 6:12 a.m.

Urgent vendor signoff protocol.

Can anyone confirm who is executing final vendor risk review in Karen Benton’s absence? Buyer has flagged clause 6.2 again. We need confirmation today.

Procurement replied first: “Wasn’t that reassigned to Tyler?”

A compliance analyst I used to mentor replied next: “Clause 6.2 is non-transferable. It names Karen by full name. It can’t be reassigned without her release.”

Then silence.

Twenty minutes later, legal replied with a red exclamation point.

Escalating to Brandon and counsel. Do not proceed until clarified.

You’d think that would stop the train.

Instead, they tried to paint over the tracks.

Tyler—the VP’s adult son with the professional depth of a baked potato—was pushed into the role of interim vendor risk lead three days earlier. He was given my old folder system, missing two critical directories, and told to “fill gaps.”

Gaps, meaning audit flags tied to seven vendor contracts, one with a known data issue that had been held together by language I personally drafted.

But Tyler wasn’t reading files.

He was “optimizing workflows,” which, based on his posts, meant color-coding Excel cells and calling it progress.

Meanwhile, the buyer’s team was watching.

Adrienne texted me that morning: They think you’ll cave.

That was the strategy. Wait me out. Assume I’d miss the paycheck, the identity, the need to matter. Assume I’d show up and be “professional” and save them like I’d saved them for fourteen years.

I didn’t miss it.

I watched the panic swirl: last-minute legal huddles, frantic Slack threads, hallway whispers, but no public acknowledgment. They were still in denial, hoping they could duct-tape the breach and smile through the investor call.

Let them.

At 9:00 a.m., the buyer’s Zoom opened.

I wasn’t invited, but I might as well have been. I knew the script. I’d helped write the playbook they were now trying to improvise.

The buyer’s lead counsel, Thomas Lind, had a voice like clean glass. Crisp. Calm. Not rushed. Men like him don’t bluff. They don’t threaten. They just state the rule and wait to see who breaks.

“Before we proceed,” he said, “we’ll need final vendor risk signoff in accordance with Section 6.2.”

A beat too long.

Brandon chuckled like a man who still believed charm could bend ink.

“Oh, you mean Karen,” he said. “She’s no longer with the company.”

I pictured him smiling as he said it, thinking he’d closed a loop.

Thomas didn’t smile.

“I see,” he said. “So the required signatory listed in 6.2 is unavailable.”

Brandon waved a hand. “We transitioned those responsibilities to another director. It’s handled.”

Some younger legal associate on our side—eager, naive, probably still thrilled to be included—nodded and added, “Procurement has reviewed and confirmed all documentation.”

Thomas paused.

Then he leaned forward just slightly.

“The language in 6.2 specifies that final vendor risk signoff must be executed by Karen M. Benton, Director of VRCC, as per the executed copy dated April 14,” he said. “The clause does not allow substitution without written release from the named party.”

Silence.

Not awkward silence.

Fatal silence.

Brandon’s smile twitched. “Surely there’s flexibility.”

Thomas raised an eyebrow. “Is there a signed release document?”

No one spoke.

Brandon tried again, voice tightening. “This is a small procedural gap. We can resolve offline.”

Thomas’s tone didn’t change.

“Do not proceed without signoff,” he said. “It’s a condition of closing. At this moment, you are non-compliant.”

And then, one by one, the buyer’s team exited the call.

Not dramatically. Not angrily.

Just… gone.

That’s how adults with leverage end conversations.

Back on our side, nobody spoke.

Not Brandon.

Not legal.

Not the CFO.

Just the soft hum of a meeting that had turned into a problem no one could joke their way out of.

At home, my inbox pinged.

Subject: Urgent signoff request — outside counsel.

Karen, as per MSA 6.2, you remain the required final signatory. Please advise availability to execute immediately.

I stared at it.

I didn’t respond yet.

Twenty minutes later, another email. Then another. Then one from Brandon.

Subject: Can we talk?

The universe has a sense of humor, even in corporate America.

By lunchtime, a courier arrived at my door with a manila envelope, return address from HQ. Inside was a printed request for release of signatory rights under 6.2. No note. No apology. Just the form, unsigned, like they thought the mere existence of paper would pressure me into obedience.

I folded it and set it beneath my leftovers like a coaster.

I ate slowly.

Salt, burnt edges, exactly the mood.

At 4:47 a.m. the next day, outside counsel emailed again.

You are still listed as active. Please advise.

No greeting. No subject line. Just panic dressed in lawyer fonts.

Sunlight poured into my kitchen in that bright American way that makes even unpaid bills look cinematic. Neighborhood kids yelled about waffles. Someone’s lawn sprinkler ticked like a metronome.

Inside, my phone lit with screenshots.

A board thread: Who authorized this termination? Was legal consulted? Where is the signed release? Get Brandon in here now.

Mark—the general counsel—had tried to spin it as an HR oversight. But you don’t lose a multi-million-dollar acquisition over “oversight.” You lose it over ego.

And ego was Brandon’s native language.

I didn’t call anyone. I didn’t post. I didn’t warn them.

Sometimes revenge isn’t loud.

Sometimes it’s just refusing to mop up the mess someone made while trying to humiliate you.

At 8:12 a.m., a new email arrived.

This one had polish.

Subject: Consulting engagement proposal — acquisitions counsel.

Karen, given your history with the vendor risk portfolio and our ongoing interest in completing the transition, we’d like to retain you for a short-term consulting engagement. Scope and compensation attached.

Signed: Thomas Lind.

PDF attached.

Retainer amount: more than my last quarter’s salary.

And nowhere, not once, did it mention Brandon.

I clicked the PDF and read the scope. Clean. Clear. Time-limited. No nonsense about culture. No demands for “alignment.” Just work, money, and respect wrapped in legal language that didn’t pretend to be my friend.

I exhaled slowly.

Then I accepted.

Not because I wanted to save them.

Because I wanted to finish what I started—on my terms, with my name back where they tried to erase it.

I set my coffee down, looked out at the ordinary American morning, and let the quiet settle.

They called my tone unacceptable.

They called my humor hostile.

They tried to cut me out like a line item.

But the deal didn’t care about their feelings.

The deal cared about a signature.

Mine.

And somewhere, in a glass tower full of people who confused buzzwords for competence, Brandon was learning the lesson nobody teaches in leadership seminars:

You can’t fire the person holding the final checkbox and still expect the system to smile and move on.

Not in the U.S.

Not when the ink is real.

Not when the clause has your name in it.

And not when the person you underestimated finally decides to stop protecting you from your own decisions.

By the time my acceptance email landed in Thomas Lind’s inbox, the panic on the twentieth floor had already become a lifestyle.

That’s the funny thing about corporate crises in America—nobody admits it’s a crisis until Legal says the quiet part out loud. Before that, it’s “a temporary delay,” “a procedural hiccup,” “a quick alignment sprint.” The words are always soft. The consequences never are.

I didn’t go back to the building right away. I didn’t rush in like a heroine racing to save the company she’d already outgrown. I stayed home, sat at my kitchen table in a sweatshirt that still smelled like laundry detergent and freedom, and read the consulting agreement twice.

No emotional fluff. No “culture fit.” No leadership coaching. Just scope, timeline, pay, and a clean statement that I would be acting as an independent consultant for the buyer’s benefit to validate vendor risk posture before closing.

In plain English: they weren’t hiring me back.

They were hiring the truth.

At 9:03 a.m. Eastern, my phone rang.

Brandon.

I watched it buzz itself tired on the counter like a trapped insect. I didn’t pick up. I didn’t decline. I let it go to voicemail because in the United States, voicemails are a gift. They’re a record. People reveal themselves when they think they’re improvising.

A minute later, another call.

Mark, the general counsel.

Then HR. Then a number I didn’t recognize, probably some outside firm whose hourly rate could buy a used Honda.

My inbox followed like a stampede.

Subject: Urgent — need your cooperation

Subject: Time-sensitive compliance request

Subject: Re: RE: Final signoff — please advise

I didn’t open the Brandon ones first. I opened Thomas’s.

His email was short, crisp, and cold in the way rich, competent men can afford to be.

We have scheduled a validation meeting at 2:00 p.m. EST. Please confirm your availability. We will provide secure access to the vendor risk portfolio and current audit materials.

No begging. No theatrics. No vague promises about valuing my legacy. Just logistics.

I replied: Confirmed.

Then I made myself a second cup of coffee and watched the morning news for exactly eight minutes before turning it off. Everything on the screen felt fake—anchors smiling, sponsors selling insurance, headlines screaming—because I knew what was real: a clause in a contract, my name typed in black, and a room full of executives learning what happens when you treat compliance like a personality.

At 10:17, Brandon emailed again.

This time with a subject line that tried to sound human.

Karen — can we please talk?

Inside, the tone was different from HR. Less polished. More frantic. Like a man who’d spent his whole life being told he was impressive, only to discover the world doesn’t accept LinkedIn confidence as a currency.

Karen, I understand there were misunderstandings. I want to resolve this quickly and professionally. We can make this right. Please call me today.

Make this right.

I stared at the phrase until it stopped looking like language and started looking like an allergy.

Because what Brandon meant was: please fix the mess I made without making me feel the consequences.

That’s always what they mean.

I didn’t reply.

Instead, I opened the executed MSA again and flipped to 6.2 like a prayer.

My name was still there, calm and indifferent.

So I did what I always did when people started lying: I prepared.

I printed the relevant section for my own binder. I opened my old vendor audit tracking sheets. I reviewed the last quarter’s flagged risk tiers—third-party access controls, invoice anomalies, data handling policies. I didn’t do it for nostalgia. I did it because I knew exactly what would happen at 2:00 p.m.

The buyer wouldn’t be emotional.

They wouldn’t be impressed by Brandon’s explanations.

They would ask for facts.

And facts were my native language.

At 1:48 p.m., I joined the secure call from my laptop. No makeup. No blazer. No performance. Just me, a clean background, and the calm face of someone who had already survived worse than a VP with a fragile ego.

Thomas Lind was there, of course. His face looked like it had never known bad sleep. Beside him sat two people I hadn’t met before: a buyer-side compliance director with a gaze sharp enough to cut through corporate nonsense, and an IT security lead who wore that dead-eyed expression of someone who has seen too many companies pretend risk isn’t real until it’s headline real.

Then, on the seller side, our company’s screen tiles popped in one by one.

Mark, pale.

The CFO, blinking like he hadn’t slept.

Brandon, overdressed, smiling too hard.

And, for the first time in all of this, I saw something I hadn’t expected: fear behind his eyes.

It wasn’t dramatic fear. It was quiet. The kind that shows up when you realize your authority was a costume, and someone just grabbed the seams.

Thomas opened.

“Karen,” he said. “Thank you for joining. We will proceed with vendor risk validation per Section 6.2. Our goal is to confirm the vendor portfolio meets the risk posture represented in the purchase agreement.”

Brandon cleared his throat like he wanted to interrupt, like he wanted to regain the stage.

Thomas didn’t give it to him.

The compliance director spoke next.

“We need confirmation on your high-risk vendor list, current remediation status, and any outstanding audit exceptions. We also need to understand whether any approvals were issued in the past ten business days without your oversight.”

That last part landed like a brick.

Because it wasn’t just about my signature.

It was about what happened after they fired me.

The CFO shifted in his chair. Mark swallowed.

Brandon still smiled.

“Of course,” I said, voice even. “I can validate the portfolio based on documentation. First, I need to confirm whether any vendor agreements were modified, renewed, or accelerated after my termination date.”

Brandon’s smile twitched.

Mark started to speak. “We—”

“I’m asking because the clause names me as the final reviewer,” I continued, still calm. “If approvals were issued after my removal, we need to assess whether those actions create material risk or misrepresentation.”

Thomas didn’t blink.

“Correct,” he said.

The IT security lead leaned forward.

“And we need access to the vendor risk archive and change logs.”

Mark’s face went a shade lighter.

Because everyone in that company knew the archive was mine. The folder structure was mine. The access matrix was mine. And the reason it worked wasn’t because it was pretty. It worked because it was built by someone who’d spent fourteen years cleaning up other people’s shortcuts.

Brandon tried to recover.

“We have everything,” he said quickly. “Our team has been maintaining the documentation.”

I looked directly at the camera.

“Which team?” I asked.

The question hung there.

Because in corporate life, “the team” is often imaginary. It’s a phrase used to cover the fact that nobody actually knows where the bodies are buried, they just assume the woman who handled it will keep handling it silently.

Brandon’s jaw tightened.

Mark finally spoke, voice strained.

“We’ve had some internal coverage.”

Thomas’s compliance director didn’t care about internal coverage.

“Provide the archive,” she said. “Now.”

Silence.

Then Mark admitted it.

“We don’t currently have access to the full archive.”

The buyer-side IT lead’s expression didn’t change, but his eyes did. They sharpened, like he’d just confirmed what he suspected.

“And why don’t you have access?” he asked.

Brandon’s mouth opened.

Mark answered first.

“Because Karen was the administrator.”

The call went quiet in a way that felt physical, like the air pressure changed.

Thomas spoke slowly.

“So the seller terminated the named signatory and administrator of the vendor risk archive before closing, without executing a release or transfer protocol.”

Brandon jumped in, voice too quick.

“It was an HR matter,” he said. “A conduct issue. We handled it internally. It doesn’t affect the deal.”

Thomas looked at him like he was looking at a cracked foundation.

“It affects the deal,” Thomas said simply.

The CFO’s shoulders sagged.

Mark closed his eyes for half a second, like he was trying to rewind time with willpower.

The buyer-side compliance director turned back to me.

“Karen,” she said, “can you provide the validation if we grant you secure access?”

“Yes,” I said. “With two conditions.”

Brandon flinched like he hadn’t expected me to have conditions.

“One,” I continued, “I need a written statement from the seller acknowledging that my termination occurred without completion of 6.2 release protocol, and that no vendor approvals issued after my termination will be represented as having my review.”

Mark’s breath caught.

“Two,” I added, “I will not sign under pressure. I will sign only after review of the complete portfolio and change logs.”

Thomas nodded once.

“Reasonable.”

Brandon’s face tightened. He was realizing in real time that he couldn’t charm his way out of this. He couldn’t “lead” his way out of a clause with my name on it. The only thing left was process.

And process was my home field.

Mark forced his voice steady.

“We can provide that statement,” he said, and it sounded like someone swallowing pride with no water.

Brandon leaned forward, voice low, trying to sound authoritative.

“Karen,” he said, “let’s be practical. We need to close. You’ve made your point.”

I didn’t react. I didn’t smile.

“My point,” I said, “was made when you fired the person holding the final compliance key.”

Thomas ended the discussion like a judge.

“Seller will provide written acknowledgment today,” he said. “Buyer will grant Karen secure access. Validation will proceed on Karen’s timeline. We will reconvene when final signoff is complete.”

Then he looked straight at Brandon.

“And we will note in the record that the delay was caused by a failure to execute the named signatory protocol.”

Brandon’s smile died.

Not slowly.

Instantly.

The call ended.

I sat back in my chair and let the silence settle in my kitchen. No applause. No victory music. Just the hum of the fridge and the distant sound of a neighbor’s leaf blower doing what leaf blowers do in American suburbs—making noise and pretending it’s productivity.

My inbox pinged again.

This time, Mark.

Subject: Written acknowledgment — urgent

Attachment: PDF.

I opened it.

It was exactly what I’d asked for. Clean, legal language. Acknowledgment of the termination date. Acknowledgment that 6.2 release protocol had not been executed. Statement that any vendor approvals issued after my termination would not be represented as reviewed by me. Signature from Mark. Signature from the CFO.

No signature from Brandon.

Of course not.

He wouldn’t sign anything that could hang him later.

I forwarded the PDF to Thomas.

Then I opened a new document and started the work.

Because the real climax wasn’t going to be me walking into a boardroom with a dramatic speech.

The real climax was going to be me reading every vendor risk flag they’d tried to ignore, every approval they’d tried to rush, every shortcut they’d taken while my badge was being cut off like a nuisance.

And I already knew, deep in my bones, that I was going to find something.

Something Brandon’s “relationship development” budget would’ve covered with a tote bag and a handshake.

Something the buyer would not forgive.

By 6:30 p.m., I had my first confirmation.

A high-risk vendor had been pushed through renewal without the final remediation memo attached. The same vendor I’d flagged twice last year for sloppy access controls.

I stared at the screen, felt that cold clarity return.

Not anger.

Not revenge.

Just inevitability.

Because in the end, corporate karma isn’t mystical.

It’s paperwork.

And the paperwork was about to tell the truth—whether Brandon liked my tone or not.

News

I’VE ALWAYS BEEN A PRACTICAL AND SIMPLE MOTHER, EVEN WITH A $6 MILLION INHERITANCE. MY SON ALWAYS EARNED HIS OWN MONEY. WHEN HE INVITED ME TO DINNER WITH MY DAUGHTER-IN-LAW’S FAMILY, I PRETENDED TO BE POOR AND NAIVE. THEY FELT SUPERIOR AND LOOKED AT ME WITH ARROGANCE. BUT AS SOON AS I STEPPED THROUGH THE RESTAURANT DOOR, EVERYTHING TOOK A DIFFERENT TURN.

The first time Patricia Wilson looked at me, her eyes didn’t land—they calculated. They skimmed my cardigan like it was…

After Dad’s $4.8M Estate Opened, My Blood Sugar Hit 658. My Brother Filmed Instead Of Helping. 3 Weeks Later, Labs Proved He’d Swapped My Insulin With Saline.

The first thing I saw was the bathroom tile—white, cold, and too close—like the floor had risen up to meet…

My Brother Let His Son Destroy My Daughter’s First Car. He Called It “Teaching Her a Lesson.” Eight Minutes Later, His $74,000 Mercedes Was Scrap Metal.

The first crack sounded like winter splitting a lake—sharp, sudden, and so wrong it made every adult on my parents’…

I WENT TO MY SON’S FOR A QUIET DINNER. SUDDENLY, MY CLEANING LADY CALLED: “DOES ANYONE ELSE HAVE YOUR HOUSE KEYS?” CONFUSED, I SAID NO, THEN SHE SAID, “THERE’S A MOVING TRUCK AT THE DOOR, A WOMAN IS DOWNSTAIRS!” I SHOUTED, “GET OUT NOW!” NINE MINUTES LATER, I ARRIVED WITH THE POLICE….

The call came in on a Tuesday night, right as the candlelight on David’s dining table made everything look calm,…

MY EX AND HIS LAWYER MISTRESS STRIPPED ME OF EVERYTHING. I OWN THIS TOWN,’ HE SMIRKED. DESPERATE, I CLOSED MY GRANDFATHER’S 1960 ACCOUNT EXPECTING $50. COMPOUND INTEREST SAID OTHERWISE, SO I BOUGHT 60% OF HIS COMPANY ANONYMOUSLY. HIS BOARD MEETING THE NEXT WEEK WAS… INTERESTING.

The pen felt heavier than a weapon. Across the glossy mahogany table, Robert Caldwell lounged like a man auditioning for…

MY PARENTS TIED ME UP AND BADLY HUMILIATED ME IN FRONT OF THE WHOLE FAMILY OVER A PRANK, BUT WHAT MY RICH UNCLE DID LEFT EVERYONE SPEECHLESS!

The rope burned like a cheap lie—dry, scratchy fibers biting into my wrists while laughter floated above me in polite…

End of content

No more pages to load