By the time my father realized I’d been quietly buying control of his American family company, it was already too late to save Hartwell Industries.

The boardroom at our Seattle, Washington headquarters smelled like expensive leather, stale coffee, and old money. Floor-to-ceiling windows framed the gray afternoon over downtown, but inside the air was thick and heavy, like the room itself knew something was about to break.

My parents sat at the head of the long mahogany table, in the kind of executive chairs you only see in U.S. business magazines and courtroom dramas. Dad—Richard Hartwell, founder and self-made manufacturing king, at least in his own mythology—occupied the center spot, back to the windows like he owned the skyline. Mom sat to his right, pearl necklace perfectly centered, blond hair immaculate in that “wealthy suburban Seattle” way.

Their CFO, Robert Chin, had his tablet propped in front of him, stylus poised, dark suit crisp. On the other side, Mark Wallace, our long-time business attorney, stacked his legal pad, pen aligned precisely with the margin.

My older sister, Victoria, sat halfway down the table in a tailored navy suit that probably cost more than my ten-year-old Honda. Her hair, her makeup, her watch, her minimalist diamond earrings—everything screamed New York hedge fund with a side of “I have people for that.”

And then there was me.

I sat at the far end of the table, so far I could have been mistaken for an assistant instead of a daughter. My printed proposal was in a simple black folder from an office supply store. No embossed logo. No leather. No monogram.

Just paper. And numbers. And six years of quiet work no one in this room knew about.

“Thank you all for coming,” Dad said, adjusting his reading glasses. His voice bounced off the wood paneling—comfortable, confident, so used to command. “We’ve called this family meeting to discuss expansion opportunities for Hartwell Industries.”

Family meeting. Right. Provided your definition of “family” came with audited financials.

“As you know,” he went on, “we’ve been approached by several potential investors interested in our manufacturing division.”

I watched his fingers rest possessively on the table, like it was an extension of him. This company had started in his garage in Tacoma, Washington, long before the downtown office and the seven-figure revenue and the “local success story” profiles in business journals. In his mind, Hartwell Industries was him. Full stop.

Mom nodded, pearls catching the overhead lights. “We want to keep this in the family if possible,” she added, smiling at Victoria. “That’s why we invited each of you to present investment proposals.”

Not each of you, I thought. Just the one of us you take seriously, and the one you tolerate.

Victoria went first, of course.

She slid a sleek laptop out of her leather bag and connected it to the screen on the wall with one brisk motion. The Hartwell Industries logo appeared, followed by a clean Title slide: “Strategic Expansion Initiative – Asia 3-Year Plan.” She even had our logo in the bottom corner like she’d already been hired.

“Good afternoon,” she began, like she was at a conference in New York and not sitting in front of her own family in Seattle. “I’m proposing a two-million-dollar investment in Hartwell’s manufacturing division.”

Two million. She let the number hang there just long enough for effect. She was good at that.

“My hedge fund connections,” she continued, “have signaled strong interest in backing Hartwell’s expansion into key Asian markets. The plan is to restructure manufacturing as a separate entity, bring in executive management from my network, and position for acquisition within three years.”

Dad beamed. Mom’s smile went soft and proud. This was their girl. The successful one. The “real business person.”

“Excellent work, Victoria,” Dad said. “Very thorough.”

“That’s my girl,” Mom echoed, eyes practically shining. “Always thinking strategically.”

Robert tapped on his tablet, brows lifted. “Victoria, what’s your expected ROI timeline?”

She flipped to a slide with neat graphs and color-coded bars. “Eighteen months to profitability, conservative estimates. Full return within four years, assuming moderate market conditions.”

“Impressive,” Mark, the attorney, murmured.

There were nods around the table, a low hum of approval, the kind of atmosphere you get when everyone has already decided how the story ends.

Then all eyes slid down the length of the table to me.

“Sophie,” Dad said. My name dropped a few degrees in temperature in his mouth. “You said you wanted to present something.”

His tone wasn’t hostile. Just… cautious. The way people speak to children holding breakable things.

I opened my plain folder. Straightened the stack of printed pages. My hands were steady. I’d practiced this.

“Yes,” I said. “I’m proposing a seven-hundred-fifty-thousand-dollar investment in the manufacturing division.”

Victoria actually laughed. Not loud. Just a little disbelieving puff of air.

“Seven hundred fifty thousand?” she repeated, like I’d suggested paying for the expansion with reward points. “That’s barely enough to—”

“It’s adequate for the improvements I’ve outlined,” I said calmly, sliding copies of my proposal across the table. One to Dad. One to Mom. One to Robert. One to Mark. I didn’t bother handing one to Victoria. She wasn’t listening anyway.

“The core of my plan,” I continued, “is to optimize existing infrastructure rather than expand prematurely. I’ve analyzed production costs, identified efficiency improvements, and developed a plan to increase output by approximately thirty-five percent without adding headcount.”

Silence met that number.

Victoria had graphs. I had math. Different religions.

Dad picked up my proposal, flipped through it quickly—too quickly to read anything—then set it down like a menu he already knew he wasn’t ordering from.

“Sophie,” he began slowly, wearing the voice he used on donors at charity galas, “this is… this is nice. I appreciate that you put something together. But this is for serious investors only.”

It landed exactly the way he intended.

“I am serious,” I said.

“Are you?” Mom’s voice slipped in, the edge so familiar it might as well have been part of my DNA. “Sweetheart, you work at a nonprofit. You make what, sixty thousand a year?” She didn’t even look at me; she looked at Dad like I wasn’t in the room.

“Where exactly would you get seven hundred fifty thousand dollars?” she asked.

“I have resources.”

“Resources?” Victoria echoed, smiling without warmth. “What resources, Soph? Did you win the lottery on your lunch break?”

“I’ve been investing for several years,” I said. “I have capital available.”

That made them pause—but not for the reason I wanted.

Dad exchanged a look with Mom. It was the look rich American parents give their “idealistic” children right before they offer to pay for grad school so they stop talking about art.

“Sophie,” Dad said, “I appreciate the effort. Really, I do. But Hartwell Industries is a seventeen-million-dollar operation. We need sophisticated investors who understand complex financial structures, not…” He hesitated, clearly searching for a word that wouldn’t sound as bad as the one in his head. “Not pretend business people playing with proposals they downloaded from the internet.”

Victoria let out a soft, amused breath. Mom didn’t even pretend to correct him.

My face stayed neutral. I had learned that skill in my twenties, the hard way. “My proposal is based on—”

“Based on what?” Mom cut in, smile gone, voice all business now. “On your extensive manufacturing experience? Your proven track record scaling American companies? Your network of industry connections?”

She softened it again mid-sentence, put that artificial sugar on top. “Honey, you’re wonderful at what you do. The charity work, the volunteering, helping people. That’s your strength. But this—” she gestured at the proposal like it was a child’s drawing—“this is out of your depth.”

Robert cleared his throat. “For what it’s worth,” he said carefully, “I did review Sophie’s proposal before this meeting. Some of her efficiency recommendations are actually quite—”

“Robert,” Dad said sharply. “We’re not going to waste time on a seven-hundred-fifty-thousand-dollar proposal when Victoria is bringing two million to the table with professional backing.”

Mom nodded, decisive. “We appreciate your input, Sophie, we do. But I think we all know which direction makes sense here.”

Victoria began closing her laptop, already moving on.

“So,” she said, snapping her slim case shut, “are we moving forward with my proposal? I have people waiting to hear back in New York.”

Dad nodded. “Let’s schedule a follow-up meeting for next week.” He turned to Robert. “Can you prepare the paperwork for a two-million-dollar capital injection? We’ll structure it as a convertible note.”

“With…” Robert started, then stopped himself. “Actually, before that, we should discuss our current capital structure.”

Dad frowned. “What’s to discuss? We’re in solid shape financially.”

“We are,” Robert said. “But our shareholder structure is… somewhat complicated.”

Mom stiffened. “Complicated how?”

Robert tapped his tablet, pulled up a spreadsheet. “Hartwell Industries has multiple investors across several funding rounds. Seed, Series A, bridge rounds. At present, the majority position—roughly sixty-two percent of equity—is held by a single investor through various vehicles.”

I kept my expression blank. I’d had years of practice.

“What investor?” Victoria asked sharply. “I thought this was a family business.”

“It is. Mostly,” Robert said. “But over the last six years we’ve taken on outside capital to fund expansion. Small amounts at first, then larger rounds as we grew.”

He swiped across the screen. Numbers and LLC names glowed faintly in the dim boardroom light.

“The primary investor is an entity called Westbridge Capital Group,” he said. “They’ve participated in every funding round since 2019. Started with a two-hundred-thousand-dollar investment, then gradually increased their position.”

“How much are we talking about in total?” Dad asked.

“Five point two million dollars,” Robert replied. “Across multiple investments.”

The room went quiet.

“Five point two million,” Victoria repeated, voice sharp as broken glass. “Why don’t I know about this?”

“Because it happened gradually,” Robert said. “No single investment was large enough to trigger special disclosure requirements under Washington State or federal securities law. But cumulatively, Westbridge Capital now holds the majority position in Hartwell Industries.”

Dad’s face flushed red. “Why wasn’t I informed about this?”

“You were, sir,” Robert said gently. “You signed off on every round. The paperwork is all in order. But I don’t think anyone realized one investor was accumulating such a large position.”

“With respect,” he added, “this is what happens when you accept capital without paying close attention to the cap table.”

Mom leaned forward, her pearls shifting. “Who is Westbridge Capital? What do they want?”

“They’re a private investment group,” Robert said. “Very hands-off. They’ve never exercised their board rights. Never requested information beyond standard quarterly reports. Honestly, they’ve been ideal investors—providing capital without interference.”

“Until now,” Mark said grimly. “If they hold sixty-two percent, they effectively control Hartwell Industries. They could force decisions, remove management, restructure operations. Under U.S. corporate law, a majority shareholder has serious power.”

“They haven’t done any of that,” Robert said quickly. “They’ve been completely passive.”

“Still,” Dad said, jaw tightening, “I don’t like the idea of some unknown investor controlling my family business.”

He looked at Robert. “I want you to look into buying back their position.”

“With what capital, sir?” Robert asked.

“We’ll figure it out. Take out loans, mortgage assets—”

“That would destabilize the entire company,” Robert cut in. “With respect, sir, Westbridge Capital has been a stabilizing force. Their capital funded your expansion into the Midwest. It paid for the new production facility outside Seattle. It helped you weather the supply chain crisis in 2022. Without their investment, Hartwell Industries would be half its current size.”

Victoria was already scrolling through her phone. “I can’t find anything about Westbridge Capital Group online,” she said. “No website. No public portfolio. No press releases. Nothing.”

“They’re private,” Robert said. “Not unusual for a family office or high-net-worth U.S. investors.”

“Family office,” Dad muttered. “Probably some trust fund kid playing investor with Daddy’s money.”

I took a slow sip of water so no one would see my lips twitch.

Mom turned to Mark. “What are our options here?”

Mark spread his hands. “Legally? Not many,” he said. “If Westbridge Capital wants to exercise their majority rights, they can. But as Robert mentioned, they’ve shown no indication of wanting to interfere. My advice?” He shrugged. “Let sleeping dogs lie. Focus on operations. Don’t poke the bear.”

“That’s not acceptable,” Dad snapped. “This is my company. I built it from nothing. Some anonymous investor isn’t going to—”

His phone rang, cutting him off. He glanced at the screen and frowned. “It’s the main office. I need to take this.”

He stepped out, the glass door slowly swinging shut behind him.

Mom sighed, smoothing an invisible wrinkle from her dress. “Sophie, honey, you’re very quiet.”

“I’m listening,” I said.

“Your proposal was sweet,” she said. “Really. But you see now why it’s not feasible, right? We have much bigger issues to deal with than small-scale efficiency improvements.”

“I understand,” I replied.

“Good. Why don’t you head out?” she suggested, like she was offering me a cookie. “This is getting into complicated financial territory. No point in you sitting through all the boring details.”

Before I could answer, the door burst open again.

Dad came back in, white as the clouds over Puget Sound.

“That was accounting,” he said. “Westbridge Capital just initiated withdrawal procedures on their entire investment. All five point two million.”

Robert sat up straight. “What? That’s impossible. The majority of their investment has lockup periods. They can’t just—”

“Apparently they can,” Dad said. “According to our head of accounting, Westbridge structured their investments with early withdrawal provisions. They’re exercising them now. All of them.”

“All five point two million?” Victoria asked, standing halfway out of her chair.

“Every cent,” Dad said. “And it gets worse.”

“Of course it does,” I thought.

He sank into his chair. “The withdrawal triggers certain debt covenants. Our line of credit with First National becomes immediately callable. Our equipment leases have co-terminous clauses. If Westbridge pulls out, everything unravels.”

Mom’s hand flew to her throat. “That can’t be right.”

“It is,” Robert said, scrolling frantically through his documents. “Jesus, I didn’t realize how interconnected everything was.” He looked up, face tight. “Westbridge’s capital was used as collateral for multiple financing arrangements. If they withdraw…”

“Say it,” Dad demanded.

“Hartwell Industries would be insolvent within ninety days,” Robert said. “We’d have to liquidate assets, lay off staff, probably file for Chapter 11 bankruptcy under U.S. law.”

The room erupted.

Victoria started rapid-fire questioning. Mom grabbed Dad’s arm like he was about to fall over. Mark’s fingers hammered across his laptop keys. Voices overlapped, sharp and panicked, the sound of people who suddenly realize gravity applies to them too.

I stayed still. Hands folded on the table. Heart pounding, yes. But my face was calm.

“This is insane,” Victoria said. “Investors don’t just pull out without warning. There must be a reason. Did we breach some agreement? Miss a reporting requirement?”

“Not that I’m aware of,” Robert said. “We’ve been fully compliant with all investor obligations.”

“Then why?” Mom’s voice had climbed into that thin, brittle register I recognized from funerals and emergency room waiting areas. “Why would they do this?”

Dad’s phone rang again.

He looked down. His eyes widened. “It’s Westbridge Capital,” he said.

Everyone froze.

“Answer it,” Victoria hissed.

He put the phone on the table and hit speaker.

“This is Richard Hartwell,” he said.

“Mr. Hartwell, this is Jessica Morrison from Westbridge Capital Group,” a crisp professional voice replied. American accent, neutral, East Coast boarding school and years of conference calls. “I’m calling to inform you officially that Westbridge Capital is exercising its withdrawal rights effective immediately.”

“Yes, we’ve been informed,” Dad said, his voice tight. “Ms. Morrison, can you tell me why? Has Hartwell Industries done something to trigger this?”

“This is purely a portfolio reallocation decision, Mr. Hartwell,” she answered. “Westbridge Capital is adjusting its investment strategy, and Hartwell Industries no longer fits our target profile.”

“Ms. Morrison, please,” Dad said, control fraying. “This withdrawal will destroy our company. We have hundreds of employees, long-standing customer relationships, community obligations.”

“I understand,” Jessica said. “And Westbridge Capital appreciates the partnership we’ve had with Hartwell Industries. However, our decision is final.”

“Can we negotiate a gradual withdrawal?” Mark cut in. “A buyout structure that doesn’t trigger debt covenants? A staged exit over twelve to eighteen months?”

“I’m sorry, Mr. Wallace,” Jessica said. “The withdrawal terms were agreed upon when the investments were made. We are simply exercising our contractual rights as they stand under U.S. law.”

“Who makes these decisions?” Victoria demanded. “Who’s the principal at Westbridge Capital? Let us speak with them directly.”

“Westbridge Capital is a private investment group,” Jessica replied. “We don’t disclose our ownership structure.”

“This is ridiculous,” Victoria snapped. “You can’t hide behind corporate veils. Someone owns this company. Someone made the decision to destroy Hartwell Industries. We have a right to know who.”

There was a pause on the line.

“One moment, please,” Jessica said.

Classical hold music filled the boardroom, tinny through the speaker. Vivaldi’s “Four Seasons,” I thought absently. They must have chosen it from a generic corporate playlist—dramatic, but safe.

Mom was crying quietly now, tears tracking down her expensive foundation. Dad stared at the phone like it was a bomb. Victoria paced beside the table like a caged animal, heels clicking on the hardwood.

Robert’s gaze flicked to me. He’d been Hartwell’s CFO for ten years. He knew numbers, patterns, the shape of money when it moved. And he’d been watching the moves of Westbridge for six.

He was starting to suspect.

The music stopped.

A new voice came on the line.

“Hello, Dad,” I said.

Silence hit the room like a physical force. I could feel it in my chest.

Dad’s face went through an entire spectrum—confusion, disbelief, recognition, shock.

“Sophie,” he whispered.

“Yes,” I said.

“You’re—” He swallowed. “You’re Westbridge Capital?”

“I own it,” I said. “Along with several other investment vehicles.”

Mom made a sound like she’d been punched. Victoria grabbed the edge of the table as if she needed something solid to hold on to.

“That’s not possible,” Dad said. “Westbridge has five point two million invested in Hartwell Industries. You work at a nonprofit. You make sixty thousand a year.”

“I make sixty thousand a year at the nonprofit,” I corrected. “That’s not my only source of income.”

“Then what is?” Victoria demanded. “Where did you get five million dollars, Sophie?”

I took a breath. It was odd, laying out my real life like this in front of people who thought they knew me.

“I started with the trust fund Grandma Helen left me,” I said. “Remember? You told me to be careful because it was ‘only’ three hundred thousand dollars and I needed to make it last.”

Dad nodded slowly, dazed.

“I invested it,” I said simply. “I made some good bets on tech startups in 2017 and 2018. Turned three hundred thousand into about two million by 2019.”

Robert’s eyes widened. Victoria blinked.

“Then I invested in cryptocurrency before the big boom,” I continued. “By 2020, I had around seven million. By 2022, about fifteen. Today I manage roughly thirty-two million dollars in assets across various investments.”

Victoria dropped back into her chair. “Thirty-two million.”

“Give or take,” I said. “Markets move.”

“But you live in that tiny apartment,” Mom said weakly. “You drive that old Honda. You shop at Target.”

“Yes,” I said. “Because I don’t need to impress anyone. I like my apartment. My car works. Target has good prices.”

Despite everything, the corner of Robert’s mouth twitched.

“The efficiency recommendations in your proposal,” he said slowly. “The production optimization, the margin improvements… You weren’t guessing.”

“No,” I said. “I’ve been reviewing Hartwell’s quarterly reports for six years. I know every aspect of your operations. I could probably run the manufacturing floor myself at this point.”

“So when you proposed seven hundred fifty thousand,” Robert said, trailing off.

“That’s what the company actually needs,” I finished. “Victoria’s two-million-dollar expansion would have overextended Hartwell exactly the way my analysis predicted. You’d be in unsustainable debt within eighteen months, forced to sell assets within two years. Best case, you’d limp through a distressed sale. Worst case, liquidation.”

Dad was staring at me like I’d been swapped with a stranger on the way in.

“You’ve been investing in my company for six years,” he said slowly. “Six years. And you never said anything. You never told us.”

“You never asked,” I replied. “You took the capital, signed the paperwork, and forgot about it. You were perfectly happy to accept money from an ‘anonymous investor.’ But when your daughter offered seven hundred fifty thousand, you called her a pretend business person.”

The words hung there, undeniable.

“Sophie,” Mom said, voice high and pleading now. “If you’re really Westbridge Capital—if you really have all this money—why are you withdrawing? Why are you destroying the family business?”

“I’m not destroying anything,” I said. “I’m withdrawing my capital from an investment that no longer meets my portfolio requirements.”

“That’s corporate speak,” Victoria snapped. “What’s the real reason?”

I looked at each of them in turn—my father clutching at the table, my mother’s mascara smudging, my sister still stunned that anyone in the family could out-deal her friends in New York.

“The real reason,” I said, “is that about an hour ago, this family made it crystal clear that I’m not a serious investor. That my proposals aren’t worth consideration. That I should stick to charity work and leave ‘real business’ to the professionals.”

“We didn’t mean—” Dad began.

“You meant exactly that,” I said. My voice was calm. Almost eerily so. “You’ve meant it for years. Every time I’ve tried to talk business, you’ve brushed me off. Every time I’ve offered advice, you’ve ignored it. The only time you took me seriously was when I showed up as a faceless LLC with a check.”

“That’s not fair,” Mom protested. “Isn’t it?” I asked. “Six years ago, when you needed capital for the Midwest expansion, I offered to invest. You laughed and told me I should focus on finding a husband instead of ‘playing business.’”

Dad winced.

“So I invested anonymously through Westbridge,” I said. “You took my money. Four years ago, when the supply chain crisis hit and you were drowning in lead times and shipping costs, I offered to help. You told me to ‘let the adults handle it.’ So I invested another million through Westbridge to keep you afloat. You took that money too.”

Victoria folded her arms. “You’re taking this personally. This is business. We were evaluating investment proposals objectively.”

“No, you weren’t,” I said. “You ‘evaluated’ my proposal for about thirty seconds before dismissing it. You didn’t read the analysis. You didn’t look at the numbers. You just saw that it came from me and decided it wasn’t worth your time.”

“For what it’s worth,” Robert said quietly, “Sophie’s proposal was excellent. Better than Victoria’s, actually. More realistic, more sustainable, better ROI potential.”

“Robert,” Dad snapped. “That’s enough.”

“I’m just stating facts, sir,” Robert replied. “Victoria’s two-million-dollar plan is impressive on paper, but over-ambitious given our current debt load and market position. Sophie’s seven-hundred-fifty-thousand-dollar plan would have actually worked.”

Victoria glared at him. “You’re taking her side.”

“I’m not taking sides,” Robert said. “I’m doing my job as CFO.”

He turned to me. “Sophie, if Hartwell accepted your proposal instead—if we acknowledged it properly—would you reconsider the withdrawal?”

I thought about it. Really thought. About the employees, the suppliers, the “local company makes good” headlines, the Christmas parties.

“No,” I said finally.

“Why not?” Dad demanded. “If your plan would save the company—”

“Because this isn’t about the proposal anymore,” I said. I gathered my papers into the simple folder. “It’s about respect. Or the complete lack of it.”

I stood.

“I’ve spent six years quietly supporting this company,” I said. “I’ve provided capital when you needed it. Stayed silent when you made mistakes. Watched from the sidelines while you celebrated yourselves as business geniuses. And today, when I finally tried to participate openly, you humiliated me.”

“We didn’t humiliate you,” Mom protested. “We just—”

“You told me I wasn’t a serious investor,” I said. “You called me a pretend business person. You literally asked me to leave the room so you could discuss ‘complicated financial matters’ without me.”

I walked toward the door, file in hand.

“Well,” I said, pausing with my hand on the handle, “now you’ll have to discuss them without my five point two million, too.”

“Sophie, wait.” Dad lurched to his feet. “Please. Let’s talk about this rationally. You’re angry. I get that. But don’t destroy your family’s business over hurt feelings.”

I turned back slowly. “I’m not destroying your business over hurt feelings, Dad. I’m making a sound financial decision. Hartwell Industries is overextended, poorly managed, and headed for trouble. Victoria’s expansion plan would have sped up the decline. As a responsible investor, I’m exiting before the situation gets worse.”

“Poorly managed,” Dad repeated, color rising again. “I grew this company from a garage in Tacoma to a seventeen-million-dollar operation.”

“You did,” I agreed. “Twenty years ago. But for the last five, you’ve been coasting on past success while making increasingly risky decisions.”

His jaw clenched.

“The Midwest expansion was overpriced for the market,” I went on. “The supply chain contracts were poorly negotiated. The timing of the Asia push is awful. And Victoria’s hedge fund friends are giving her advice that benefits their exit, not your long-term stability.”

“You don’t know what you’re talking about,” Victoria snapped.

“I know exactly what I’m talking about,” I replied. “I’ve been analyzing this company for six years. I’ve read every report, studied every decision, tracked every metric. I probably know Hartwell Industries better than any of you at this point.”

“Then help us,” Mom said, her voice breaking. “If you know so much—if you care so much—help us fix it instead of abandoning us.”

“I tried,” I said. “You rejected my help. You called me a pretend business person.”

“I’m sorry,” Mom said, tears spilling. “I’m sorry, okay? I didn’t know. We didn’t know. We were wrong about you. Please, Sophie, please don’t do this.”

Three months earlier, that might have worked. The plea, the tears, the “we didn’t know.”

Not anymore.

“Jessica Morrison from Westbridge will coordinate the withdrawal details with Robert,” I said. “The process will be complete within thirty days. Dad. Mom. Victoria. Good luck with the business. I hope you find investors who meet your standards.”

I walked out.

Behind me, I heard my father shouting my name, Victoria demanding I come back, my mother sobbing. The sounds followed me down the hallway like ghosts.

By the time I reached the elevator, my phone started vibrating in my bag.

I didn’t look at it.

By the time I got home to my small one-bedroom apartment in Seattle’s Rainier Valley, I had seventeen missed calls—nine from Dad, five from Mom, three from Victoria. The voicemails stacked up like accusations.

I blocked all three of them. Temporarily. I needed silence.

An hour later, my phone rang again.

Jessica.

“Hey,” I answered.

“Well,” she said, a dry smile in her voice, “that sounded dramatic.”

“How bad is it?” I asked.

“Hartwell is in full crisis mode,” she said. “Their attorney has called me three times asking about the withdrawal timeline. Robert wants to discuss alternative structures. Your father left me a message that was essentially incoherent shouting.”

“And the withdrawal itself?” I asked.

“Proceeding on schedule,” Jessica said. “The paperwork is ironclad. We drafted it that way for a reason. They can’t block it, delay it, or renegotiate. Thirty days from now, every cent of that five point two million will be out of Hartwell Industries.”

“And then?” I asked quietly.

“Based on their current financials?” she said. “They’ve got about sixty days after that before the debt covenants start snapping. Their line of credit with First National is already flagged. If they can’t plug the hole, they’ll be looking at asset sales, layoffs, maybe a restructuring bankruptcy. Chapter 11 at best. Liquidation at worst.”

I felt something twist in my stomach. Faces flashed in my mind—people I’d seen on plant tours, names I’d read in reports. They weren’t numbers to me. Never had been.

“How many people lose their jobs if they liquidate?” I asked.

“Seventy-three employees,” Jessica said. “If they manage a structured bankruptcy, maybe half of those can be saved. Maybe.”

I closed my eyes.

“Sophie,” Jessica said gently, “we can still restructure the withdrawal if you want. Give them breathing room. Stage it out. There’s a version where they survive, just smaller.”

“No,” I said. The word came out faster than I expected. “No. We’re not doing that.”

“You’re sure?”

“I’m sure,” I said. I wasn’t, not really. But I had spent so long making myself small for these people that I couldn’t bear the idea of cushioning their fall with my spine again. “This isn’t just about today. It’s about years. Years of being dismissed. Of being treated like I was stupid. Of being excluded from the family business while they happily took my money.”

“I understand,” Jessica said. She was one of the few people on earth who really did. “There’s something else I should tell you.”

“Please say it’s that you’ve discovered a heartless side of me and we can monetize her,” I said weakly.

She laughed softly. “Not exactly. Robert called me directly.”

I sat up straighter on my worn sofa. “When?”

“Right after the meeting,” she said. “He wanted me to tell you something.”

“Okay…”

“He’s known for months,” she said.

“Known what?”

“That you were Westbridge,” Jessica replied. “He put it together about six months ago. The patterns of the investments, the timing, the focus on long-term stability over quick wins. He said it was obvious once he really looked.”

“And he didn’t say anything?” I asked.

“He said he was waiting to see what you did,” Jessica said. “He said he respected that you had reasons for staying anonymous. And…” she hesitated, “he also said he’s impressed as hell and if Westbridge Capital ever needs a CFO, he’d love to be considered.”

Despite everything, I smiled.

“Good to know,” I said.

After we hung up, I sat in my quiet apartment, looking around at the life my family thought was pathetic. Faded rug. Second-hand bookshelf. Spiral notebooks stacked on the coffee table. A tiny kitchen where the most extravagant thing I owned was a high-end coffee grinder.

I could have been living in a penthouse overlooking Elliott Bay, driving something German and shiny. Instead, I was here. On purpose.

My phone buzzed with a text from an unknown number.

Robert Chin.

I know you blocked your family. I respect that. But I wanted to tell you something.

I stared at the screen, then typed back: I’m listening.

His reply came fast.

I reviewed Victoria’s proposal more carefully after you left. It’s worse than I thought. If Hartwell had accepted it, the company would have been insolvent within 24 months. Your proposal was the only sound option on the table. Your family are idiots. You’re brilliant.

I blinked hard. Then sent: Thank you.

Seriously, he replied. If you ever need a CFO, call me.

I smiled for real this time.

I’ll keep that in mind, I wrote.

The story hit the Seattle Business Journal three days later.

LOCAL MANUFACTURING COMPANY FACES FINANCIAL CRISIS AFTER LOSS OF PRIMARY INVESTOR.

The article detailed how Hartwell Industries, “a long-standing American family business based in Seattle, Washington,” had suddenly lost its main investor, Westbridge Capital Group, and was now scrambling to satisfy lenders. They quoted unnamed sources, mentioned debt covenants, explained callable credit lines in simplified terms for readers who weren’t fluent in corporate finance.

By day five, the dominos started to fall exactly the way Jessica had predicted.

“First National just called their line of credit,” she said on the phone. “Hartwell has thirty days to repay two point three million or face asset seizure.”

“Can they repay it?” I asked, though I already knew the answer.

“Not without emergency funding,” she said. “And nobody wants to fund a company that just lost its majority investor under mysterious circumstances. Every serious investor in the U.S. knows how to read between those lines.”

“What about Victoria’s hedge fund friends?” I asked.

“They pulled out,” Jessica said. “Apparently they did a little extra due diligence and discovered the same problems you flagged. Overextended operations, thin margins, shaky expansion plans, overreliance on one investor. They decided there were better places to park their capital.”

I rubbed my forehead. “And my dad?”

“Trying to mortgage personal assets,” she said. “The house, his investment portfolio, everything. But it won’t be enough. The hole is too big, and lenders are spooked.”

“And the employees?” I asked quietly.

“Layoffs started yesterday,” she said. “Twenty people so far. More coming next week.”

After we hung up, I lay on my couch and stared at the ceiling. The cracks in the paint formed faint, branching lines—like the graphs I’d drawn in my notebooks when I first realized where Hartwell was heading if they didn’t change course.

This was what I wanted, right?

For them to understand.

For them to feel, if only for a moment, what it was like to be powerless in the face of someone else’s decision.

My phone rang again. Unknown number.

I almost let it go to voicemail.

“Hello?”

“Miss Hartwell?” A woman’s voice, lightly accented, tired. “This is Janet Rodriguez. I work—worked—at Hartwell Industries in production.”

I sat up. “Ms. Rodriguez, I’m… I don’t know how you got this number.”

“Robert gave it to me,” she said. “He said he shouldn’t, but he did. I know I shouldn’t be calling either, but I wanted you to know something.”

Her voice was steady, but there was strain under it, like a wire pulled too tight.

“I’ve worked at Hartwell for twelve years,” she said. “It’s been a good job. Good benefits, decent pay, supportive management. I have three kids. My husband is disabled. This job is our whole income. Was.”

My throat tightened.

“Robert told me what happened,” she said. “He told me you’re the investor who pulled out. He told me why.”

A tear slid down my cheek before I realized I was crying.

“I don’t know you,” she continued. “I don’t know your family. But I know what it feels like when people don’t see you. When they act like you don’t matter.”

“Ms. Rodriguez—”

“I’m not calling to beg,” she said quickly. “I’m calling because you need to hear this part too. Whatever happens to Hartwell, it’s not your fault. Your parents should have treated you better. Your sister should have respected you. Robert says you tried to help and they refused. That’s on them, not you.”

“How many people have lost their jobs?” I asked, wiping my face.

“Twenty so far,” she said. “They say another thirty by the end of the month. The rest when the company closes, if it comes to that.”

“I’m sorry,” I whispered.

“Don’t be sorry,” she said. “Just… I don’t know… Just be successful. Be brilliant. Show them what they missed. That’s the best revenge, right?”

After she hung up, I sat there for a long time with my phone in my hand.

Then I called Jessica.

“I need you to do something,” I said.

“Name it,” she replied.

“I want you to contact every employee who’s being laid off from Hartwell,” I said. “Production, admin, everyone. Tell them Westbridge Capital is hiring for a new manufacturing operation. Same pay, same benefits, same positions if we can. We’ll cover relocation if necessary.”

Jessica went silent.

“Sophie,” she said then, carefully. “That’s going to cost you. A lot. You’re talking about launching a full manufacturing operation from scratch in the U.S. with legacy wages and benefits. This is not a cheap revenge fantasy.”

“I know exactly what it’s going to cost,” I said. “Do it anyway.”

“You’re starting an entire company just to save Hartwell’s employees?” she asked.

“I’m starting an entire company because there’s a trained, talented workforce about to hit the market and I’d be an idiot not to hire them,” I said. “Also because Robert Chin is apparently available and would make an excellent CFO.”

Jessica laughed under her breath. “You’re really doing this.”

“Yes,” I said. “And I want to do it right. Sustainable growth. Healthy margins. Long-term stability. Everything Hartwell should have been but wasn’t.”

“What about your parents?” she asked. “Your sister? They’ll see this. They’ll know you’re poaching their people, starting a competing operation in the same American market.”

“Good,” I said. “Let them see. They wanted ‘serious investors’ and ‘real business people.’ Now they get to find out what that actually looks like.”

Six weeks later, I stood in the middle of a renovated warehouse in South Seattle, watching my new company come to life.

The space used to belong to a logistics outfit; now it was Westbridge Manufacturing. The freshly painted concrete floors still smelled faintly of chemicals. New equipment hummed, fork-lifts beeped, voices bounced between the high steel beams.

Former Hartwell workers—my workers now—were setting up assembly lines, labeling shelves, checking inventory. People who’d expected to lose everything were laughing as they argued about workflow diagrams.

Robert walked over, tablet in hand. He’d traded his old Hartwell badge for a Westbridge ID and looked ten years lighter because of it.

“We’ve got fifty-three of the seventy-three Hartwell employees on board,” he reported. “The rest either found other jobs or moved out of state. Fifty-three is more than enough to start operations.”

“Good,” I said. “What are we calling this place officially?”

“I thought you’d want to decide that,” he said.

I looked around at the warehouse—the people, the machines, the blank walls waiting for a logo.

“Westbridge Manufacturing,” I said. “Simple. Clear. The name already means something on the money side. Let’s make it mean something on the factory floor too.”

“I like it,” Robert said. He smiled. “Your parents are going to lose their minds.”

“They already have,” I said.

It was true. Hartwell Industries had filed for Chapter 11 bankruptcy three weeks earlier in a federal court downtown. Dad had mortgaged the family home, cashed out his retirement accounts, sold whatever stocks he had left. It wasn’t enough. The company was being broken down and sold off like a car for parts.

“Have they tried to contact you?” Robert asked.

“Constantly,” I said. “Calls. Texts. Emails. I’m still blocking them.”

“Maybe you should talk to them at some point,” he said. “Not to reconcile, necessarily. Just to get closure.”

“Maybe,” I said. “Eventually. Not yet.”

My phone buzzed in my pocket.

I glanced at the screen. Jessica.

“You have a visitor at the main office,” she said when I picked up. “Says it’s urgent.”

“Who?”

“Victoria,” she said. “She’s in the reception area. I told her I had to check with you before letting her back.”

I looked at Robert.

He shrugged. “Might as well face one of them sometime.”

“Send her back,” I told Jessica.

Twenty minutes later, I walked into Westbridge Capital’s downtown Seattle office—a modest suite on the fifteenth floor of an older building—and found my sister in one of the cheap black reception chairs.

She did not look like the polished woman from the boardroom.

Her hair was pulled back in a messy knot, mascara smudged under her eyes. Her blazer was wrinkled, blouse buttoned crooked at the cuff. She looked like someone who’d had a long, ugly night and then kept going.

“Sophie,” she said, standing up.

“Victoria,” I said.

“Can we talk?”

I nodded toward my office. Jessica raised an eyebrow as we passed; I gave a tiny shrug. She retreated back to her desk, but I could feel her attention like a laser through the wall.

Victoria sank into the chair opposite my plain wooden desk and looked around. No art. No imposing bookshelf. No view of the Space Needle. Just a functional workspace with a laptop, a plant I was trying not to kill, and a stack of printed reports.

“This is your office?” she asked.

“Yes.”

“It’s so…” She searched for a word. “Plain.”

“I like plain,” I said.

She laughed once, a broken sound. “Of course you do. God, we really didn’t know you at all, did we?”

I didn’t answer.

“Hartwell is gone,” she said. “The bankruptcy court will dissolve it officially within the month.”

I nodded. I read court filings like other people read celebrity gossip.

“Dad lost the house,” she went on. “Mom moved in with Aunt Liz in Tacoma. I’m back in my tiny apartment, trying to figure out how to salvage my career after my ‘brilliant’ expansion plan helped blow up the family business.”

“I’m sorry that happened,” I said. And I was. For all of us.

“Are you?” she asked, eyes searching mine.

“Yes,” I said. “I never wanted Dad to lose everything. I just wanted him to see me.”

She was quiet for a long moment.

“He sees you now,” she said. “We all do.”

She took a breath, like bracing for impact.

“You were right about everything,” she said. “My expansion plan was a disaster waiting to happen. Your efficiency proposal would have saved the company. You’re not a pretend business person. You’re better at this than any of us ever were.”

“Thank you,” I said. The words weren’t enough, but they were true.

“That’s it?” she asked. “Just ‘thank you’?”

“What do you want me to say, Victoria?” I asked.

She stared down at her hands. “I don’t know. Maybe that you forgive us. That you’ll help us rebuild. That family matters more than business. Something.”

I leaned back.

“I forgive you for underestimating me,” I said. “I don’t forgive you for how cruel you were about it. And I’m not going to help rebuild Hartwell. There’s nothing to rebuild. The assets are being auctioned. The legal entity is dead.”

She flinched.

“As for family mattering more than business,” I added, “you’re the one who treated me like I didn’t matter. You’re the one who made business more important than family.”

“I know,” she whispered. “God, Sophie, I know. I was awful to you. We all were.”

She wiped her eyes angrily. “Is there any way to make this right? Between us, I mean. Maybe not today. But eventually?”

“Maybe,” I said honestly. “But not today.”

She nodded slowly, accepting the not-yet like an answer she’d expected.

“I can live with that,” she said.

She stood up, then hesitated. “For what it’s worth, I heard you hired most of the Hartwell employees. That you’re starting your own manufacturing operation.”

I nodded.

“That’s… good of you,” she said. “Those people didn’t deserve to be collateral damage in our family war.”

“No,” I said. “They didn’t.”

“One more thing,” she said, hand on the door handle. “Dad wanted me to ask you something. He’s too proud to do it himself, but he asked anyway.”

“What?”

“Would you consider buying Hartwell’s remaining assets?” she asked. “The brand name, the equipment, the customer relationships. The bankruptcy court is auctioning everything. Dad thought if you bought it, if you kept the Hartwell name alive somehow, it would mean the legacy wasn’t completely destroyed.”

I thought about it.

“How much are the assets valued at?” I asked.

“About one point three million for the whole package,” she said. “Maybe a little less if nobody else bids.”

“I’ll think about it,” I said.

“Really?” she asked, hope flickering in her eyes.

“Really,” I said. “Not for Dad. Not for the ‘legacy.’ Because some of that equipment is good, and having access to the client list could accelerate Westbridge Manufacturing’s growth by eighteen months. If it makes business sense, I’ll bid.”

She swallowed. “Thank you. Even if you’re doing it for the numbers.”

“Especially if I’m doing it for the numbers,” I said. “That’s the only language anyone in this family ever respected.”

She gave a small, sad smile. “You’re going to be incredibly successful, aren’t you?”

“I already am,” I said.

“No,” she said, shaking her head. “I mean… famous. Powerful. The kind of person Forbes and The Wall Street Journal profile. The kind of name people whisper in meetings in New York and Silicon Valley.”

“Maybe,” I said. “If I want to be.”

“Do you?” she asked.

“I haven’t decided yet,” I said. “Right now I’m focused on building something good. Something sustainable. Something that treats people with respect.”

“That’s a dig at Hartwell,” she said.

“If the shoe fits,” I replied.

After she left, Jessica came into my office.

“How’d it go?” she asked.

“As well as it could,” I said. “She apologized. I didn’t forgive her. We acknowledged reality. Adult stuff.”

“Are you really going to bid on Hartwell’s assets?” she asked.

“Yes,” I said. “The equipment’s worth it, and the client list will save us a year and a half of cold outreach. It’s a bargain if we can get it under one point two.”

“Always the investor,” she said, smiling. “You know, your family spent years calling you uncommercial, too soft for business, not cutthroat enough. Turns out you’re the most ruthless one of all.”

“I’m not ruthless,” I said. “I’m just clear-eyed about what matters.”

“And what matters?” she asked.

“Building something real,” I said. “Treating people well. Succeeding on my own terms. And proving everyone who underestimated me was wrong.”

“Mission accomplished on that last one,” she said.

“Not yet,” I replied. “But soon.”

The auction results came in a week later.

Robert found me on the factory floor, tablet in hand, grinning like he’d just watched his favorite team win the Super Bowl.

“We got it,” he said.

“Got what?” I asked, though I already knew.

“Everything,” he said. “Westbridge Manufacturing acquired all Hartwell’s equipment and client relationships for one point one million. We were the only bidder willing to take the entire package. Everyone else wanted scraps.”

“And the Hartwell name?” I asked.

“That went separately,” he said. “Some investment group bought the intellectual property—the trademarks, the logo, the whole brand—for fifty thousand. Oakridge Holdings. Never heard of them.”

“I have,” I said.

He blinked. “You know them?”

“I own them,” I said. “Oakridge is one of my smaller vehicles.”

Robert stared at me. “You bought your family’s company name?”

“I bought the rights to a defunct American brand that might have value someday,” I said. “It’s just business.”

“Sophie,” he said, shaking his head, half horrified, half impressed. “That’s cold. Even for you.”

“Is it?” I asked. “Or is it smart asset acquisition?”

He laughed. “I can’t tell if you’re the hero or the villain of this story.”

“Maybe both,” I said. “Or maybe neither. Maybe I’m just someone who got tired of being underestimated and decided to do something about it.”

A few weeks later, my phone buzzed with a notification while I was reviewing production schedules in my office.

Jessica’s message popped up: Don’t freak out. But you’re in Forbes.

The online feature was titled: “The 30 Under 30 Investor You’ve Never Heard Of: How a Seattle Nonprofit Worker Quietly Built a $38 Million Portfolio.”

Thirty-eight. I smiled. Markets had been kind.

The article traced my investment history, from Grandma Helen’s modest trust fund to tech startups to crypto to Westbridge Capital. It laid out my anonymous involvement in Hartwell Industries, my decision to withdraw, the creation of Westbridge Manufacturing. They’d interviewed Robert, quoted satisfied employees, and included commentary from financial analysts in New York calling my approach “innovative, disciplined, and unusually ethical for the American mid-market.”

There was a photo of me in my office, taken by a photographer who’d seemed surprised my workplace didn’t look like a movie set. I was wearing jeans and a simple top I’d actually worn to Target the previous weekend. My hair was in a low ponytail. No expensive jewelry. No designer branding.

Just me. In front of a blank wall and a whiteboard full of numbers.

My phone rang.

Mom.

For the first time in weeks, I answered.

“Sophie,” she said, voice breaking. “I saw the article. Everyone’s seen it. My friends are sending it to me from all over the country.”

“I know,” I said.

“You look beautiful in the photo,” she said.

“Thank you,” I answered.

“I’m so proud of you,” she said. I could hear her crying. “Your father is too. Even if he won’t say it to you yet. What you’ve built, what you’ve accomplished—it’s extraordinary.”

“Thank you,” I repeated. The words landed differently this time.

“I need to say something,” she said. “And I need you to really hear me.”

“Okay.”

“I’m sorry,” she said. “Truly. Deeply. Sorry for how I treated you. For dismissing your intelligence. For underestimating your abilities. For acting like you were… less. I was wrong. Completely wrong.”

I looked out through the office window at the warehouse floor. Production was humming along. Workers moved with easy familiarity. It looked like what Hartwell had pretended to be all those years—a healthy American manufacturing operation taking care of its people.

“I appreciate that,” I said.

“Is there any chance we could have dinner?” she asked. “Just you and me. No business talk, unless you want to. I’d like to try to rebuild our relationship. To get to know you—the real you. Not the version I had in my head.”

“Maybe,” I said. “But Mom, I need you to understand something first.”

“Anything,” she said quickly.

“I’m not the same person I was a year ago,” I said. “I’m not going to shrink myself to make you comfortable anymore. I’m not going to pretend I don’t know things so you can feel like the expert. I’m not going to hide my success to protect anyone’s ego.”

“I understand,” she said. “And I don’t want you to. I want to know the real Sophie. The brilliant investor. The successful businesswoman. The woman who built all this.” Her voice cracked. “The daughter I should have seen all along.”

“We can have dinner,” I said.

“Thank you,” she whispered. “There’s one more thing.”

Of course there was.

“What?” I asked.

“Your father,” she said. “He’s… struggling. Financially, yes. But emotionally too. He feels like a failure. Like he destroyed his legacy and lost his daughter. He’s too proud to reach out first, but he needs to hear from you.”

“I’ll think about it,” I said.

After we hung up, I found Robert on the floor, standing near a finished pallet, checking numbers.

“Family drama?” he asked.

“Always,” I said. “Mom wants dinner. Dad’s… drowning. Victoria is probably somewhere trying to rebuild her reputation on LinkedIn.”

“Are you going to help them?” he asked.

“Help them how?” I said.

“I don’t know,” he replied. “Co-invest in something new. Give them bridge funding. You could solve their financial problems with a single wire. You know that.”

I thought about it. Thought about wiring a couple million dollars back into the man who had called me a pretend business person in front of a room full of people.

“No,” I said.

“No?” he repeated.

“They need to solve their own problems,” I said. “They spent years treating me like I couldn’t handle real business. Like I needed to be protected from complicated financial matters. Let them figure it out on their own now.”

“Harsh,” he said.

“Realistic,” I corrected. “I’ll have relationships with them—if they’re willing to see me as I actually am. But I’m not going to rescue them. That’s not my job.”

Robert smiled. “You really are ruthless.”

“I prefer ‘clear-eyed about boundaries,’” I said.

“Fair enough,” he said.

He handed me his tablet. “Speaking of boundaries, and conquering everything that used to belong to people who underestimated you… we got the final confirmation from the bankruptcy court.”

I scanned the screen.

“Westbridge Manufacturing officially acquired all Hartwell’s equipment and client relationships,” it read. “Oakridge Holdings holds the intellectual property rights to the Hartwell name and brand.”

I handed the tablet back.

“Good,” I said.

“You know,” Robert said, shaking his head, “I still can’t decide if you’re the hero or the villain in this story.”

“Maybe I’m neither,” I said. “Maybe I’m just someone who stopped auditioning for a part in a family drama and decided to write her own script.”

We stood there for a moment, watching the production line move smoothly, efficiently. Machines whirred. People laughed. Boxes were sealed, labeled, stacked.

My phone buzzed again.

Dad.

I opened the text.

Saw the Forbes article. You were right about everything. I’m sorry I didn’t listen. I’m sorry I didn’t see you. Congratulations on your success. You earned it. Love, Dad.

I read it twice. Then held the phone out so Robert could see.

“Are you going to respond?” he asked.

“Eventually,” I said. “Not today.”

“Why not?”

“Because today I’m busy running my company,” I said. “Building my empire. Succeeding on my own terms. The family drama can wait.”

Robert laughed. “You know what? You’re going to be just fine.”

“I know,” I said.

And I was.

News

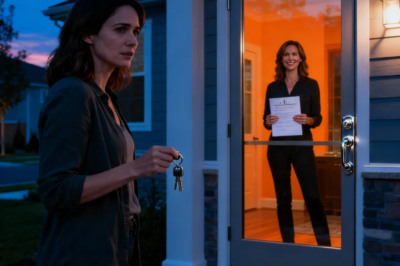

PACK YOUR THINGS. YOUR BROTHER AND HIS WIFE ARE MOVING IN TOMORROW,” MOM ANNOUNCED AT MY OWN FRONT DOOR. I STARED. “INTO THE HOUSE I’VE OWNED FOR 10 YEARS?” DAD LAUGHED. “YOU DON’T ‘OWN’ THE FAMILY HOME.” I PULLED OUT MY PHONE AND CALLED MY LAWYER. WHEN HE ARRIVED WITH THE SHERIFF 20 MINUTES LATER… THEY WENT SILENT.

The first thing I saw was the orange U-Haul idling at my curb like it already belonged there, exhaust fogging…

I was at airport security, belt in my hands, boarding pass on the tray. Then an airport officer stepped up: “Ma’am, come with us.” He showed me a report—my name, serious accusations. My greedy parents had filed it… just to make me miss my flight. Because that morning was the probate hearing: Grandpa’s will-my inheritance. I stayed calm and said only: “Pull the emergency call log. Right now.” The officer checked his screen, paused, and his tone changed — but as soon AS HE READ THE CALLER’S NAME…

The plane dropped through a layer of gray cloud and the world outside my window sharpened into hard lines—runway lights,…

MY CIA FATHER CALLED AT 3 AM. “ARE YOU HOME?” “YES, SLEEPING. WHAT’S WRONG?” “LOCK EVERY DOOR. TURN OFF ALL LIGHTS. TAKE YOUR SON TO THE GUEST ROOM. NOW.” “YOU’RE SCARING ME -” “DO IT! DON’T LET YOUR WIFE KNOW ANYTHING!” I GRABBED MY SON AND RAN DOWNSTAIRS. THROUGH THE GUEST ROOM WINDOW, I SAW SOMETHING HORRIFYING…

The first thing I saw was the reflection of my own face in the guest-room window—pale, unshaven, eyes wide—floating over…

I came home and my KEY wouldn’t turn. New LOCKS. My things still inside. My sister stood there with a COURT ORDER, smiling. She said: “You can’t come in. Not anymore.” I didn’t scream. I called my lawyer and showed up in COURT. When the judge asked for “proof,” I hit PLAY on her VOICEMAIL. HER WORDS TURNED ON HER.

The lock was so new it looked like it still remembered the hardware store. When my key wouldn’t turn, my…

At my oath ceremony, my father announced, “Time for the truth-we adopted you for the tax break. You were never part of this family.” My sister smiled. My mother stayed silent. I didn’t cry. I stood up, smiled, and said that actually I… My parents went pale.

The oath was barely over when my father grabbed the microphone—and turned my entire childhood into a punchline. We were…

DECIDED TO SURPRISE MY HUSBAND DURING HIS FISHING TRIP. BUT WHEN I ARRIVED, HE AND HIS GROUP OF FRIENDS WERE PARTYING WITH THEIR MISTRESSES IN AN ABANDONED CABIN. I TOOK ACTION SECRETLY… NOT ONLY SURPRISING THEM BUT ALSO SHOCKING THEIR WIVES.

The cabin window was so cold it burned my forehead—like Michigan itself had decided to brand me with the truth….

End of content

No more pages to load